Paper money

The printed piece of paper (or, sometimes, similar synthetic fiber) that represents a fiduciary value is called paper money or bills. It replaces currency metal, which, especially in large quantities, is more uncomfortable to always carry in your hand or pocket.

The term paper money refers to any document with fiduciary value also called Recognized Money and not only legal tender. In Spain, the following are considered paper money: the (bank) bill, the real voucher, the bearer obligation, the provisional certificate, the silver certificate and some similar documents. In Mexico, the term paper money is used more in the official sphere, and ticket more in everyday life.

The most well-known and widely used paper money is the bank note, usually issued by a central bank or public authority as fiat currency. In another time, it was exchangeable without time limitation for metallic coin and backed by its equivalent in precious metals. Currently, it only circulates as legal tender and is not exchangeable for gold or silver. Formally, it is a printed paper, with various designs, brands and signatures that guarantee its authenticity.

History

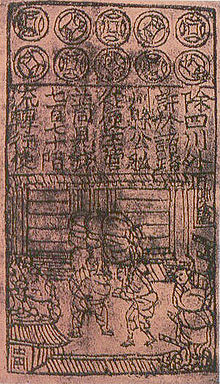

Its origin is in China in the VII century, although its use was not official until the year 812 (IX). The importance of a means of exchange that facilitated trade between the inhabitants of a population gave rise to currency as a means of exchange.

In the 13th century, a Venetian citizen named Marco Polo undertook a long journey to China, an amazing journey for the time.. The notes that he made during the trip contain the first references that exist in the West about the production and use of paper money, an incomprehensible form of payment for the prevailing conditions in Europe at that time. To Marco Polo's contemporaries, this information seemed fanciful and unworthy of credibility. The famous explorer's assertions could only be verified years later, with banknotes issued during the XIV century by the Ming dynasty. The Chinese called the banknotes: Flying money. Due to their low weight and the ease with which they circulated over a relatively large area. By the X century, they already had a very well-structured circulation system. Shortly after paper money came into existence, the inevitable counterfeiters appeared. There are files that describe the fight that the Chinese authorities waged against this problem. The penalties applied were not a small thing and the crime of forgery was punishable by the death sentence of the person involved.

In Europe, the first banknotes of which there is evidence appear in Sweden in the year 1661 (17th century) by the Stockholms Bank (Stockholm Bank) founded by the moneychanger Johan Palmstruch, who delivered them as a "receipt" for those who deposited gold or other precious metal. They arrived in Spain in 1780, during the reign of Carlos III, and their use quickly became popular as they were much more comfortable to wear. Thus, it was not necessary to carry the famous bag full of coins, much more striking and heavy.

Until not long ago, banknotes were backed by the gold standard, that is, each issue of money made by the authorities of a country had to be backed by a certain amount of gold. This continued until the 1970s or so, when gold was discontinued as the backing of the currency in 1971.

Forgery

Although the counterfeiting of gold and silver coins was less profitable because the value of the metal constituted the essential part of its value, the banknotes are still simply paper and, therefore, are attractive pieces for fraud, Therefore, banks provide them with a series of security measures. Current banknotes are made with special paper made of elongated cotton fibers and with complex printing techniques, such as watermarks, holograms and invisible ink, to avoid counterfeiting.

Often the composition of the paper includes linen, cotton or other textile fibers. Some countries, such as Australia, Mexico, Brazil, Paraguay, Chile, Guatemala, New Zealand and Hong Kong, produce polymer banknotes to increase their resistance throughout their use and to allow the inclusion of a transparent window of a few millimeters. Different kinds of holograms have even been inserted, security measures that are very difficult to reproduce with normal printing techniques.

Generally, in addition to counterfeiting, alteration or marking of banknotes is also punishable.

Security measures

In order to avoid counterfeiting, different security measures are used:

- Water or filigree mark: the paper has one or more images formed by differences of thicknesses that are seen in the transluce.

- Blanqueador: Paper without optical bleachers is used — in this way it cannot be counterfeited using common paper — or used only in a region. This can be detected with an ultraviolet light source.

- Reliefs: the paper is highlighted in different parts.

- Optically variable ink (OVI): is an ink that changes color according to the angle of the observer and the incidence of light.

Dynamic smart currency encryption

Dynamic Intelligent Currency Encryption (DICE) is a security technology introduced in 2014 by the British company EDAQS, which remotely devalues banknotes that are illegal or stolen. The technology is based on identifiable tickets -which can be an RFID chip or a barcode- and is connected to a digital security system to verify the validity of the ticket. The company claims the banknotes are unforgeable and help solve cash-related problems, as well as fight crime and terrorism. On another note, DICE benefits cover and solve almost all cash-related issues that governments see as a motivation for phasing out cash.

Contenido relacionado

Flag of the savior

Hijra

Maus