Organization of Petroleum Exporting Countries

The Organization of Petroleum Exporting Countries (OPEC) is an organization recognized since November 6, 1962 by the United Nations (UN), thanks to resolution number 6,363.

OPEC had its headquarters in Geneva (Switzerland) between 1960 and 1965, then moved it to Vienna, thanks to the facilities granted by the Austrian government. OPEC "can have a great influence on the oil market, especially if it decides to reduce or increase its level of production".

43% of world oil production and 81% of world oil reserves are found in OPEC member countries. Its dominance in crude oil exports, for the third quarter of 2016, is at about 34.9%. In addition, it concentrates all the necessary oil production capacity in the world, which, de facto, makes the Organization of Petroleum Exporting Countries the central bank of the oil market.

Members

OPEC is made up of 13 countries from Africa, Asia and the Americas. In yellow the founding states.

For countries that export oil at a relatively low volume, their limited bargaining power as OPEC members would not necessarily justify the burdens imposed by OPEC production quotas and membership costs, which is why some countries have left the organization..

Odds

At first, OPEC made sporadic adjustments to its quotas, but in recent years it has followed a policy of multiple changes, trying to finely adjust production to demand. For example, between March 2004 and March 2006, OPEC readjusted its production quotas ten times.

| Date | Place | Decision | Cuota | Comments |

|---|---|---|---|---|

| February 1998 | Vienna | Fixed quota | 27.30 mb/d | The price of Brent oil falls to $10 per barrel |

| April 1998 | Riad / Vienna | 1,355 mb/d | 25.95 mb/d | ... |

| July 1998 | Amsterdam / Vienna | Recipe 1,255 | 24,69 mb/d | ... |

| April 1999 | The Hague / Vienna | Rising 1,716 mb/d | 22,97 mb/d | ... |

| March 2000 | Vienna | Increase 1.716 mb/d | 24,69 mb/d | Price band created between $22 and $28 |

| July 2000 | Vienna | Increase 0.708 mb/d | 25,40 mb/d | Oil price exceeds $30 |

| September 2000 | Vienna | Increase 0.8 mb/d | 26.20 mb/d | ... |

| October 2000 | Vienna | Increase 0.5 mb/d | 26,70 mb/d | ... |

| January 2001 | Vienna | Step 1.5 mb/d | 25.20 mb/d | ... |

| March 2001 | Vienna | 1.0 mb/d | 24.20 mb/d | ... |

| September 2001 | Teleconference | 1.0 mb/d | 23.20 mb/d | Complaint after the attacks of 11 September 2001 |

| January 2002 | Cairo | Step 1.5 mb/d | 21,70 mb/d | ... |

| January 2003 | Vienna | Increase 1.3 mb/d | 23,00 mb/d | ... |

| February 2003 | Vienna | Increase 1.5 mb/d | 24,50 mb/d | ... |

| June 2003 | Vienna | Increase 0.9 mb/d | 25,40 mb/d | ... |

| November 2003 | Vienna | Rp 0.9 mb/d | 24,50 mb/d | ... |

| March 2004 | Algiers | 1.0 mb/d | 23,50 mb/d | ... |

| July 2004 | Beirut | Increase 2.0 mb/d | 25,50 mb/d | ... |

| August 2004 | Pact in Beirut | Increase 0.5 mb/d | 26,00 mb/d | ... |

| September 2004 | Vienna | Increase 1.0 mb/d | 27,00 mb/d | ... |

| December 2004 | Cairo | 1.0 mb/d | 27,00 mb/d | The cut is applied on overproduction |

| January 2005 | Vienna | ... | ... | Price band between $22 and $28 is suspended |

| March 2005 | Isfahan (Iran) | Increase 0.5 mb/d | 27,50 mb/d | ... |

| June 2005 | Vienna | Increase 0.5 mb/d | 28,00 mb/d | ... |

| September 2005 | Vienna | ... | 28,00 mb/d | OPEC offers full capacity pumping |

| March 2006 | Vienna | ... | 28,00 mb/d | OPEC withdraws its supply of pumping to full capacity |

| October 2006 | Doha, Qatar | Recreate 1,2 mb/d | ... | The cut is applied on a real pumping of 27.5 mb/d |

| December 2006 | Abuya, Nigeria | 0.5 mb/d | ... | The cut is applied on 1 February, on 26.3 mb/d |

- Ecuador withdrew in January 2020

History

Post World War II Situation

In 1949, Venezuela and Iran took the first steps in the direction of OPEC, inviting Iraq, Kuwait, and Saudi Arabia to improve communication between the oil-exporting nations as the world recovered from World War II. At the time, some of the world's largest oil fields were coming on production in the Middle East. The United States had established the Interstate Oil and Gas Compact Commission to join with the Texas Railroad Commission in limiting overproduction. The United States was simultaneously the world's largest producer and consumer of oil and the world market was dominated by a group of multinational companies known as the 'Seven Sisters', five of which were headquartered in the United States after of the breakup of John D. Rockefeller's original Standard Oil monopoly. The oil-exporting countries were eventually motivated to form OPEC as a counterbalance to this concentration of political and economic power.

1959-1960 wrath of exporting countries

In February 1959, as new supplies became available, multinational oil companies unilaterally reduced their published prices for crude oil from Venezuela and the Middle East by 10%. Weeks later, the first Arab League Oil Congress met in Cairo, Egypt, where influential journalist Wanda Jablonski introduced Abdullah Tariki of Saudi Arabia to Venezuela observer Juan Pablo Pérez Alfonzo, representing the two largest nations. oil-producing companies outside the United States and the Soviet Union. Both oil ministers were angered by the price cuts, and the two led their fellow delegates to establish the Maadi Pact, calling for an "Petroleum Consultation Commission" of exporting countries, to which multinational oil companies should submit price change plans. Jablonski reported marked hostility towards the West and a growing protest against the " absentee landlord " from the multinational oil companies, which at the time controlled all oil operations within the exporting countries and wielded enormous political influence. In August 1960, ignoring warnings, and with the United States favoring Canadian and Mexican oil for strategic reasons, the multinational oil companies again unilaterally announced significant cuts in their published prices for Middle Eastern crude.

1960-1970

These were OPEC's formative years, as the organization - which began its existence with five developing oil-producing countries - sought to assert the rights of member countries in a dominated international oil market. by the "Seven Sisters". Activities were generally low-key, as OPEC was setting its targets, creating the Secretariat - which moved from Geneva to Vienna in 1964 - adopting resolutions and negotiating with companies. The number of members increased to ten in the 1970s. OPEC's initial objectives were:

- Regulate the oil market, so that it serves the interests of producers and not of the consumer countries.

- Obtaining profitable prices for producers, since for some it is the only source of wealth.

They have 72% of world reserves and 42% of production. Its position will be favored by the continuous increase in world consumption, which almost tripled from 1960 to 1973. The world energy base rests progressively on this hydrocarbon.

1970-1980

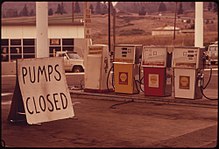

OPEC gained international prominence during this decade, as member countries took control of the oil sector and gained a say in setting crude oil prices on the world market. In this decade there were two crises in the price of oil, caused by the Arab oil embargo in 1973 -and OPEC's unilateral decision to triple its crude oil sales prices- and by the outbreak of the Iranian revolution in 1979. two crises were exacerbated by basic market imbalances. Both led to a sharp increase in oil prices.

In 1970 the first symptoms of the crisis appeared. Libya (Gaddafi) puts pressure on the concessionary companies to reduce production in order to raise prices. The Tapline pipeline rupture weakens crude markets. OPEC meets in Caracas later this year. It is decided to actively participate in pricing. The barrel was at $1.20.

In February 1971, the Tehran agreement was signed with the producing companies for the joint fixing of prices (which was to last 5 years) and a formula to protect the price of crude oil to compensate for possible depreciation of the dollar (the Bretton Woods system was about to fall). During the period 1970-1973, prices doubled. The oil markets are noticing for the first time the importance that OPEC had gained. The barrel was at $3.75 in 1973.

In 1973 it was the fourth Arab-Israeli war in September 1973 (Yom Kippur). OPEC (with an Arab majority) decides to raise the price by 70% and impose an embargo on the countries that had supported Israel, starting with the USA. In December 1973, a barrel of oil became worth $11.65 (a rise of more than 200%).

The first summit of OPEC heads of state was held in Algiers in March 1975. The organization admitted its fifteenth and last member country - the Republic of the Congo - in 2018. Qatar, a country that joined OPEC in the In 1961, it will become the first Persian Gulf nation to withdraw from the organization since its creation in 1960.

After this event, in 1975 the pro-Arab Venezuelan terrorist Ilich Ramírez led the Command seconded by Hans Joachim Klein and Gabrielle Krocher Tiedemann that stormed the OPEC headquarters in Vienna and took 42 hostages including all the oil ministers of the member countries and his own countryman Valentín Hernández Acosta.

Between 1973 and 1978 prices, in current dollars, experienced some not very high rise.

In December 1978, OPEC decided to gradually increase the price of crude oil during 1979 to achieve a total increase of 14%. The barrel reached $29.2. Consumers tried to advance their purchases and producers to delay sales. The markets are therefore clouded. The revolution in Iran (Khomeini) and the withdrawal of Persian oil (generating a marginal shortage) end up clouding the market and causes a large part of the oil contracted in installments to be diverted to the "spot" (cash) to obtain higher prices).

In January 1981, the barrel reached US$36.

1980-1990

Prices peaked early in the decade due to the Iranian revolution and the start of the Iraq-Iran war, in which both sides bombed their fields and refineries.

High prices also encouraged exploration, which lowered demand for OPEC crude.

In December 1982, the production regulation policy was adopted for the first time to control prices by the OPEC member countries, which are set for all its members, taking as reference parameters the amount of reserves and the production capacity of each country.

Saudi Arabia, acting as a 'hinge' producer, reacted by cutting production to keep the price high. The hinge role forced Riyadh to lower and lower its extraction, which hit a low of less than 2 mb/d in 1985. At the end of that year, after multiple warnings, Saudi Arabia abandoned the hinge position and raised its production, which caused a collapse in prices in 1986 (thus producing the third oil price crisis).

Towards the end of the decade, prices increased, but without reaching the high levels of the early 1980s. Environmental issues began to enter the international agenda.

1990-2000

The decade begins with the Iraqi invasion of Kuwait, which sends the price of oil above $30 a barrel. The rest of OPEC members respond by raising their production.

Since then, prices remained relatively stable until 1998. At that time, the Asian crisis, which substantially reduced demand, together with an increase in OPEC production, caused prices to collapse. After falling to 14.22 dollars per barrel, the arrival of a new government in Caracas improved relations between Saudi Arabia and Venezuela.

With his oil policy, the late Venezuelan President Hugo Chávez made a decisive contribution to getting OPEC out of a deep crisis and raising the prices of “black gold” by close to one thousand percent during his mandates. As soon as he came to power, the president promised to change the oil strategy and reduce the offer agreed in the Organization of Petroleum Exporting Countries (OPEC).

Chávez wanted, in his words, to “resuscitate” OPEC activity and ensure that crude oil has “a fair price for producers and consumers” in international markets. The lack of compliance with production levels by Venezuela and other partners had prevented raising the "petroprices" which, as a result of the Asian financial crisis, had plummeted in 1998 to the lowest level in 14 years. But even before assuming power, the Venezuelan president's team had begun intense negotiations to overcome the differences between the producers and to be able to control the supply. Ali Rodríguez Araque, who was going to be Venezuela's oil minister, met in Madrid in December 1998 with his counterparts from Saudi Arabia and Mexico. The objective was to promote a reduction in supply by OPEC and other large producers. And these efforts led to the fact that, at the end of March 1999, at the first OPEC meeting after Chávez came to power, the group agreed to a sharp cut in their joint crude production, and Rodríguez Araque assured that Venezuela had “ learned the lesson" and would not breach commitments again. Thanks to the policies of Hugo Chávez, OPEC resurfaces, reaching new prices established by the band strategy.

The new government of Hugo Chávez takes advantage of the better diplomatic relations between Iran and Saudi Arabia, even convincing their partners to establish a mechanism to adjust the gross price of crude oil. By June 2000, the price of a barrel had reached an average of 26 dollars. basically due to the unexpected demand from the Asian markets, which placed a greater burden on crude oil production. That same year, in September, the OPEC world summit on its 40th anniversary meets in Caracas.

2000-2010

The production cuts that OPEC agreed to starting in 1999 achieved their objective and at the beginning of 2000 the price of oil exceeded the psychological barrier of 30 dollars per barrel for the first time since 1986. The group sets a price target in the form of a band between 22 and 28 dollars per barrel in 2000.

OPEC reacts to high prices with increases in its production, but a strong increase in demand, from China and India as large consumers, added to production problems (the oil strike in Venezuela from December 2002, the suspension of exports from Iraq in 2001 and the invasion of Iraq in March 2003) led to further price increases.

Crude reached practically 80 dollars per barrel in the summer-winter of 2006. In mid-July 2007 the value was above 72 dollars per barrel. Since October of this year, it has been above 90 dollars per barrel.

In 2008 the Government of Indonesia announced that it would disassociate itself from the Organization, until now it was the only country in Southeast Asia, however it remained a member until the end of the year. It has left open the possibility of returning to OPEC if it manages to increase its production. He finally rejoined the bloc in 2015.

2014–2016

During 2014–2015, OPEC members have consistently exceeded their production caps, and China also experienced a slowdown in its economy. At the same time, oil production in the United States nearly doubled from 2008 levels, due to substantial improvements in fracking technology, itself a response to record oil prices. Other aggravating factors that have caused the price of oil to collapse include the attempt to create independence in oil production in the United States, which led to a sharp decline in demand for imports in this country and a record volume of inventories. oil.

Despite global oversupply, Saudi Arabian oil minister Ali Al-Naimi blocked calls by poor OPEC members to cut production in Vienna on November 27 to reduce the price of oil. Naimi argued that the oil market should be left to swing back to lower price levels, thereby ending the profitability of high-cost US fracking production and strategically gaining back its share of the OPEC market. in the long term. As he himself explained in an interview:

Is it reasonable for a high-efficiency producer to reduce its production, while the producer with low efficiency continues to produce? That's twisted logic. If I reduce, what will happen to my portion of the market? The price will go up and the Russians, the Brazilians and the US oil producers will grab my portion... We want to tell the world that high-efficiency producing countries are those that deserve a portion of the market. This is the operational principle in all capitalist countries... One thing is certain: Current prices (more or less $60 per barrel per day) do not support all producers.

A year later, when OPEC met on December 4, 2015, the organization had already exceeded its production cap for 18 consecutive months and US production had only declined slightly from its peak. While hundreds of the world's leaders were in the Paris Agreement making commitments to limit carbon emissions, oil producers cut spending to sustain themselves despite low prices. Indonesia was going to join OPEC again and Iran was already going to start its production after years of suffering international sanctions for its nuclear program. Therefore, OPEC decided to waive any cap on its production until the next ministerial conference, scheduled for June 2016. On January 20, 2016, OPEC's reference price basket was lowered to $22.48 per barrel per day – less than a quarter of its June 2014 high ($110.48), less than a sixth of its July 2008 record ($140.73), and below the starting point of its all-time rise in April 2003 ($23.27).

2016-2021

In 2016 the 13 OPEC countries achieved a new alliance in which they included 10 countries led by Russia which they would call OPEC+ (also known as OPEC Plus) for which they increased to 23 participating countries. The ten new members are: Russia, Mexico, Kazakhstan, Azerbaijan, Bahrain, Brunei, Malaysia, Oman, Sudan and South Sudan. This new group began to formalize in 1996 as important countries in terms of production volume and set strategies with OPEC. as of 2016, for which reason they do not have to respect the decisions made by OPEC regarding certain issues, however, they can actively participate in the discussions of this organization.

In 2018 the Republic of the Congo joined OPEC

In January 2020 Ecuador withdrew from OPEC. In March 2020, the lack of agreements between OPEC and Russia to lower oil production to keep crude prices high, due to the international economic collapse caused by the COVID-19 pandemic, reached the extreme that Saudi Arabia flooded the oil market at a price of 25 dollars a barrel producing a sharp drop in prices

On June 1, 2021, OPEC and OPEC+ with their 23 countries reached an agreement during the 17th Ministerial Meeting held virtually to gradually incorporate 2.1 million average barrels per day into the world market during the May period -July considering that the world demand for oil could grow by 6 million barrels per day to reach 96.5 million barrels per day on an annual average, and estimating that the demand reaches 99 mbd during the last quarter of 2021. However, it is up to them discuss and distribute the quotas that by the beginning of July had not yet reached an agreement The rise in the price of a barrel forces OPEC+ to meet to reach agreements at the end of June While Arabia and Russia debate the increase in production, Iraq supports the extension of the OPEC+ agreement to reduce production until December 2022

On October 5, 2022, the 45th Meeting of the Joint Ministerial Oversight Committee (JMCS) and the 33rd OPEC+ Ministerial Meeting were held in Vienna with a duration of 30 minutes. A cut in production equal to 2,000,000 barrels per day (B/D) was approved, which would be applied as of November. While Russian oil, also sanctioned by the West due to the invasion of Ukraine, has held up better than expected, with supply being exported at a discount to China and India.

Main Bodies

- Conference: It is made up of senior officials who designate each country, The Board of Governors is an organism that takes day to day the problems affecting OPEC and prepares the agenda that ministers resolve.

- General Secretariat: He is the legal representative of the Executive Organization and Head of the Secretariat. In this capacity, which manages the affairs of the Organization in accordance with the instructions of the Board of Governors

Previous consultations

On the occasion of the First Arab Oil Congress, held in Cairo, in April 1959, Juan Pablo Pérez Alfonzo, representative of Venezuela, held informal consultations with the representatives of Iran, the United Arab Republic, Saudi Arabia, Kuwait, and the Arab League. These consulted were called "the gentleman's agreement."

In view of the great utility of the informal consultations that were held at that time, the aforementioned persons undertook to bring to their respective governments the idea of constituting as soon as possible an Oil Consultation Commission within which common problems could be discussed to reach competing conclusions.

It was estimated that the consultative commission should meet at least once a year, in addition to the meetings that, at the request of one or more of the governments in question, were deemed appropriate due to special circumstances that motivated them.

The problems that were discussed and on which a general agreement was reached were the following:

- Improved participation of oil-producing countries on a reasonably equitable basis. The agreement was reached that the Governments concerned should focus on formula 60 - 40 to parity with the trend of new contracts in other countries. It was suggested that taxes, preferably income, should be treated separately from participation, even if the final formula of participation should consider the sum total of the various elements that form it.

- Convinced to the integration of the oil industry. It was suggested that such integration could ensure stable markets for producing parties, avoiding the transfer of profits from one phase of operations to another, which affected the Government ' s oil revenues.

- Convinced to increase the refining capacity of the producing countries by establishing an oil industry to maximize the benefits derived from oil resources and to maximize the use or preservation of natural gas.

- Establishment of National Petroleum Companies to operate alongside existing private companies.

- The need to establish agencies in each country to coordinate nationally the conservation, production and exploitation of oil.

Baghdad Convention

It was at the first OPEC conference, where the "Agreement signed in Baghdad, on September 14, 1960, between the representatives of Iraq, Iran, Kuwait, Saudi Arabia and Venezuela, was approved, in the which provisions were adopted to unify the oil policy of the member countries and for this purpose it was decided to form a permanent body called Organization of Petroleum Exporting Countries.

"At the invitation of the Republic of Iraq, the Conference of the Petroleum Exporting Countries, composed of the representatives of the Republics of Iraq, Iran, Kuwait, Saudi Arabia and Venezuela, hereinafter referred to as Members, met in Baghdad from September 10 to 14, 1960, and having considered:

- That members have in place many necessary development programs, mainly funded by the entries from their oil exports.

- Members must rely heavily on oil revenues to balance the national annual budget.

- That oil is a perishable wealth and to the extent that it is being exhausted must be replaced by other wealth.

- That all nations of the world, to maintain and improve their living standards, have to count almost entirely on oil as the primary source of energy generation.

- That any fluctuation in the price of oil necessarily affects the march of the "Member Programmes", and is a damaging dislocation, not only for their own economies, but also for those of all consumer nations. It has decided to adopt the following resolutions:

Resolution #1

- - That members will not be able to remain indifferent to the attitude taken so far by oil companies in making price modifications;

- - That members will require oil companies to keep their prices stable and free from any unnecessary fluctuation; that members will seek to re-establish current prices, by all means at their disposal, at the prevalent levels before the reductions, which will ensure that if any new circumstances arise that oil companies need price modifications, such companies must enter into consultations with the affected member or members to fully explain the circumstances;

- - That members will study and develop a system to ensure price stabilization, including through the regulation of production with due attention to the interests of producer and consumer nations and the need to ensure stable income to producer countries, an efficient, economic and regular supply of this source of energy to consumer nations, and a fair profit for their capital to those who invest in the oil industry;

- - That if, as a result of the implementation of any unanimous decision of this conference, any direct or indirect reprisals by any interested company against one or more member countries shall be used, no other member shall accept any offer of advantageous treatment, either in the form of an increase in exports or price improvements, which could be offered by one or more such companies with the intention of discouraging the implementation of the unanimous decision made by the conference.

Resolution #2

- - With a view to realizing the forecasts of Resolution No. 1, the conference decides to form a permanent body called Organization of the Petroleum Exporting Countriesfor regular consultations among its members to coordinate and unify the policies of the members and to determine, among other matters, the attitude that members must adopt whenever circumstances arise, such as those contemplated in paragraph 2, of Resolution 1.

- - The countries represented at this conference will be founding members of the organization of the oil-exporting countries.

- - Any country with a substantial net export of oil can become a member if it is unanimously accepted by the five founding members of the organization.

- - The main objective of the organization will be the unification of oil policies by Member countries and the determination of the best means of safeguarding the interests of individual or collective member countries.

- - The organization will meet at least twice a year, and if necessary, more frequently, in the Capital of one or another of the member countries or anywhere else that is advisable.

- (a) A secretary of the Organization of the Petroleum Exporting Countries will be established to organize and coordinate the work of the organization.

- (b) A subcommittee formed by at least one member from each country will meet in Baghdad by 1 December 1960 to prepare and submit to the next conference a draft regulation concerning the structure and functions of the secretariat, to propose the budget of the secretary for the first year and to study and propose the most convenient headquarters for the secretariat.

Contenido relacionado

Check

Olympe de Gouges

United Nations Industrial Development Organization