Macroeconomy

The macroeconomics is the part of economic theory that is in charge of studying the global indicators of the economy through the analysis of aggregate variables, such as the total amount of goods and services produced, the total of income, the level of employment, of productive resources, the balance of payments, the exchange rate and the general behavior of prices. In contrast, microeconomics studies the economic behavior of individual agents, such as consumers, companies, workers, and investors.

The macroeconomic approach

Macro and micro

The term macro- comes from the Greek makros which means large, and initially the meaning of the terms macro economy and micro economics was intended to keep a certain parallel to the physical distinction between the macroscopic level and the microscopic level of study. In the first it would import the emergent properties associated with thousands or millions of interacting autonomous components, while in the "micro" it would be a question of describing the behavior of the autonomous components under the actions to which they were subjected. However, in modern usage macroeconomics and microeconomics are not parallel terms of the physical terms "microscopic" and "macroscopic".

The microscopic approach focused on the behavior of economic agents and on the foreseeable results of their actions under certain stimuli, under certain behavioral hypotheses. However, for a complex economy made up of thousands or millions of agents, as in the physics of million-particle systems, the "micro" it is unfeasible. That is why a "macro" in which abstraction was made from a good number of magnitudes and facts related to economic agents, and an attempt was made to find balances of aggregate variables. Thus, the macro approach focused on income levels, interest rates, savings, consumption and total spending due to all agents. Aggregate behavior was modernized by hypothetical functions that are supposed to describe the approximate qualitative behavior of certain relationships between macrovariables.

In the early 1950s macroeconomists developed micro-based models of macroeconomic behavior (such as the consumption function). Dutch economist Jan Tinbergen developed the first nationally comprehensive macroeconomic model, which he first developed for the Netherlands and then applied to the United States and the United Kingdom after World War II. The world's first economic modeling project, the Wharton Econometric Forecasting Associates LINK (Wharton Econometric Forecasting Associates LINK) was initiated by Lawrence Klein and was named in his call for the Alfred Memorial Economics Prize. Nobel from the bank of Sweden in 1980.

In the 1970s he contributed parts to understanding the whole. As one learns more about each economic school, it is possible to combine aspects of each to reach an informed synthesis.

Origin

The origin of modern macroeconomics must be located in 1936, when the British economist John Maynard Keynes published his work General theory of employment, interest and money, which contained an explanatory theory of the great Depression. Economists who had preceded him believed that business cycles could not be avoided, while Keynes discussed the possibility of high unemployment at any given time and how fiscal and monetary policy could be used as powerful tools to increase the level of unemployment. production and employment in a society.

Macroeconomic data

Macroeconomics bases its analysis on data derived from observation and statistics, their measurement and studies show the success or failure of an economy. The main data used in macroeconomics are:

- Macromagnitudes, extracted from the National Accounting which summarizes in a single figure the monetary value of economic activity, the most used indicator is the gross domestic product (gross domestic product - GDP), which measures the value of all the goods and services produced by a country for a year. It is understood that the ultimate end of economic activity is to provide goods and services to individuals, that the provision of a greater amount of goods provides the success of an economic system. The variation in gross domestic product shows the evolution of production growth.

- Consumer Price Index

- Unemployment rate

- Interest rate

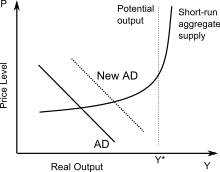

Aggregate Demand and Aggregate Supply

The aggregate supply and demand model is the model that tries to explain economic reality, analyzing the production of a period and the existing price level through the functions of aggregate supply (O) and demand (D) and provides the necessary scheme to understand the evolution of the basic aggregate magnitudes. The "O" and "D" aggregates is the fundamental instrument for the study of fluctuations in production and the price level. It serves to understand the consequences of different economic policies. The basic components of this analysis are aggregate demand and aggregate supply, aggregate demand is a representation of the market for goods and services, its components are private consumption (C), private investment (I) and public spending (G), in an open economy we must add net exports (XN) (difference between exports (X) and imports (M)) of goods and services.

Aggregate supply is defined as the total quantity of goods and services offered for sale at various possible average prices. This model is useful for the analysis of inflation, unemployment, growth and, in general, the role played by economic policy.

Macroeconomic Issues

Macroeconomic issues refer to specific aspects of the general functioning of an economy without considering particular sectoral aspects or problems. In this sense, macroeconomic models and macroeconomic policies try to represent aspects such as economic growth, unemployment and the evolution of wages, inflation, the trade balance, aggregate demand, taxes and interest rates as main aspects.

Monetary economics: money and inflation

Monetary economics shows the analysis of money in its various functions in an economic system and examines the effects of monetary systems, including the regulation of money and those associated with financial institutions. The modern analysis of monetary economics provides a microeconomic formulation of the demand for money and studies its influence on aggregate demand and production.

Economic growth

Economic growth studies the factors that determine the increase in production, income or in general economic indicators of a country or region, in the long term. The theory of economic growth analyzes why some economies grow faster than others and what are the limits to growth.

Labor market and unemployment

Unemployment is a phenomenon present in current economies and constitutes one of the most important problems they face, highlighting the inability of economies to generate situations in which there are jobs for everyone who wants to work. The macroeconomic study of unemployment includes the meaning of unemployment in the economy, its measurement, the causes that generate it and the manifestations of unemployment in a society.

International Economy

The current economies of the countries are characterized by the great importance that their relationship with the rest of the world has acquired. The area of international economics of macroeconomics studies the consequences of a country's economic relations with the exterior, including international trade, protectionism, international financial relations, the balance of payments and the fixing of exchange rates.

The Aggregate Demand Model

The following is an example model (IS-LM model). We will consider the economy of a country (or any other area) looking at the variables of its National Accounts.

IS curve

Consider national income ('Y') as the sum of all goods and services produced in a period, say a year. However, some of these goods and services have served for the consumption of the country's inhabitants, that is, (C) will be consumption, others will have served so that companies can replace their capital needs for produce (machinery, tools, raw materials, etc.), we will call this investment (I); For its part, the country's government has also intervened in the economy by consuming goods and services to make them public or has intervened through public companies in the market, which we will call public spending (G). Goods have also been imported from abroad, through imports (M) and have been exported abroad, through exports (X). So, we can represent the income as this sum:

(1a)And=C+G+I+X− − M{displaystyle Y=C+G+I+X-M,}

The reason why imports happen "subtracting", is the following: the side of the equation Y + M represents what we have used all the money used in the period, the total national production of goods and services, and imports, and that has had to be used for all that has been demanded during the period: C + I + G + X (since some of these variables have been taken partly from national production and partly from imports). Therefore Y + M = C + I + G + X, and passing M to the other side, we have the relation (). We can simplify and call the last two variables "Net Exports", and present it like this:

(1b)And=C+I+G+XN{displaystyle Y=C+I+G+X_{N},}

We must now introduce factors that influence consumption. Consumption is assumed to be a part of the disposable income of consumers. But what is disposable income? We might think that it is Y, but since the government needs part of that income to finance public spending (G), we can assume that disposable income is And after the government has withheld a portion in the form of taxes, and we present them in simplified form by a tax rate ('t') (With 0<= t <=1, although t = 0 or t ='1 would be too unlikely in reality). Thus, disposable income will be (1-t)Y. Now, the consumer, normally, will not spend all of it on consumption, but only a part, we can assume that on average everyone has the same propensity to consume, and we call this (c) propensity. Therefore, private consumption will be:

C=c(1− − t)And{displaystyle C=c(1-t)Y,}

We plug this into our equation and it would look like this:

And=c(1− − t)And+I+G+XN{displaystyle Y=c(1-t)Y+I+G+X_{N},}

Another assumption that is usually made is that private investment is negatively affected by interest rates on money. When these are high, as companies tend to ask for bank loans to equip their means of production, they tend to invest less because investing more means having to pay more interest and principal. We can represent this as follows: Investment has a maximum possible level (Im) and it decreases linearly with interest rates, that is:

I=Im− − b⋅ ⋅ i{displaystyle I=I_{m}-bcdot i,}

Where b represents the sensitivity of private companies to the bank interest rate and i that interest rate. Our model now looks like this:

And=c(1− − t)And+Im− − b⋅ ⋅ i+G+XN{displaystyle Y=c(1-t)Y+I_{m}-bcdot i+G+X_{N,}

The point is that in this model we see that the same variable, income, appears on both sides of the equation. This can be interpreted as a dynamic relationship, that is, the value of Y on the left will depend on the value it had in the past, on the right of the equation, and on the rest of the values of the variables. And it will change period after period.

However, if we assume that the other variables did not change, if the parameters were constant for long enough, and also public spending G was exogenously generated, then income would possibly not change either. over time, reaching what is called the equilibrium value. We can find this equilibrium value:

(2nd)And=Im− − b⋅ ⋅ i+G+XN1− − c(1− − t){displaystyle Y={frac {I_{m}-bcdot i+G+X_{N}}}{1-c(1-t)}}}}

With this equation, also called the IS curve, various analyzes can be made, seeing how equilibrium income would change if the parameters or variables involved were to change. This curve reflects the values of income (Y) and interest rate (i) for which the market for goods and services is in equilibrium. There is, however, an important difference if it is considered that spending is not exogenous but endogenous and given by the tax level: G = tY, since in this case income equilibrium would be:

(2b)And=Im− − b⋅ ⋅ i+XN(1− − c)(1− − t){displaystyle Y={frac {I_{m}-bcdot i+X_{N}}{(1-c)(1-t)}}}}

Note that the exogeneity hypothesis of public spending is not innocent, since the conclusion about the effect of the tax increase is contrary in () and () since calculating the following derivatives we have:

(▪ ▪ And▪ ▪ t)G=cte.≤ ≤ 0,(▪ ▪ And▪ ▪ t)G=tAnd≥ ≥ 0,{displaystyle left({frac {partial Y}{partial t}}{G={mbox{cte}}}leq 0,qquad left({frac {partial Y}{partial t}}{right)_{G=tY}geq 0,

In other words, in the endogenous public spending model, an increase in taxes leads to a decrease in income, while in the public spending model equal to taxes (non-deficit) the increase in the tax rate leads to increases in rent.

LM curve

There is a curve that is complementary to this, called LM. Let's see what it consists of: Agents demand money to be able to act in the market. Money interests in real, not nominal terms. What does this mean? What do price levels matter? The money supply depends on the country's Central Bank, which is the only body that can issue money, but it then lets the rest of the banks distribute it and charge interest for lending it. In any case, Monetary Demand can be represented as the quotient of two variables, M, the total amount of money in the economy, and P, price levels. That is to say (M/P). That demand can be assumed to depend on the rest of the economy as follows: the higher the income level, the more money will be demanded to buy in the markets, but a higher interest rate will generally deter money demand, since it must be repaid when it is used. ask for a loan. Hence, the demand is represented as follows:

MP=kAnd− − hi{displaystyle {frac {M}{P}}=kY-hi}

If we assume that money supply and demand are equal in the money market, we can take the above equation and solve for income:

(3)And=(M/P)+hik{displaystyle Y={frac {(M/P)+hi}{k}}}}}

What is a curve that relates the levels of income and interest rates for which the money market is in equilibrium. This is the LM curve.

IS-LM Balance

If we take the IS and LM curves (very simple because this is an example model), () and (), and put them together we obtain a system of two equations with two variables, which will be income and the interest rate:

And=Im− − bi+G+XN1− − c(1− − t),And=(M/P)+hik{displaystyle Y={frac {I_{m}-bi+G+X_{N}{1-c(1-t)}}}}}{qquad Y={frac {(M/P)+hi}{k}}}}}}}

We can solve, using the methods for systems of linear equations, and obtain the values of Y and i as a function of all other parameters and variables and use the functions results to study how the levels of income and interest rate will vary in equilibrium when the parameters or exogenous variables vary. Moreover, we can obtain the Aggregate Demand curve, since we will be able to express income (Y) depending on price levels (P). This curve would have the following expression:

(4th)And=1h[chuckles]1− − c(1− − t)]+bk[chuckles]h(Im+G+XN)+MbP]{displaystyle Y={frac {1}{h[1-c(1-t)]+bk}}}}left[h(I_{m}+G+X_{N})+{frac {Mb}{P}}}{right]}

This expression can be reduced to one of the type Y=A+B/P, which clearly shows that it is of a decreasing curve in P. If we had started from () and () the final result would have been:

(4b)And=1h(1− − c)(1− − t)+bk[chuckles]h(Im+XN)+MbP]{displaystyle Y={frac {1}{h(1-c)(1-t)+bk}}}}left[h(I_{m}+X_{N})+{frac {Mb}{P}}}{right]}

If, in addition, we developed an aggregate supply curve that related levels of wages, labor, prices, and produced income, we could cross it with the aggregate demand curve and completely determine income, price levels, employment, and others. at any given time and study how the government's monetary and fiscal policies could influence, for example, achieving the appropriate levels of prices or employment.

Relevant fact: The IS-LM comparative statics model can be applied to explain Say's law which says that supply equals demand.

Instruments of macroeconomic policy

The economic authorities have tools to achieve economic objectives, the main ones are monetary policy, which consists of changing the money supply, managing money, credit and the banking system, which can affect production, prices and employment. The other great tool of economic policy is fiscal policy, which consists of the use of public income, basically taxes, and public spending to achieve the objectives set. Income policies that are the instrument for limiting prices and wages.

Dynamic Stochastic General Equilibrium Models

In recent decades, one of the most frequently used mathematical models to analyze the impact of economic measures is the EGDE, although it is more frequently treated in postgraduate programs than undergraduate programs. In part, this model has displaced the IS-LM model as the primary analysis tool.

Macroeconomic models

The possible economic relationships are many and very complex. Simplifying assumptions are made to study broadly what happens with the different economic variables involved when changes occur in the economic environment studied. Depending on the assumptions made, what relationships are considered or not, what kind of effects these relationships transmit, how this transmission is made, and what real world values are supposed to represent the variables used, some models will be obtained. or others, hence there is a great variety of models that predict or explain different things about the functioning of the macroeconomy.

Generally, a school of economic thought has associated models because it attaches more importance to certain economic variables than others or assumes that the relationships of these variables with the rest are of a different nature. Hence the diversity of models.

For example, there is, in the IS-LM model, a case in which it is assumed that the demand for money does not depend on the interest rate, but only on the level of income (called the classical model). If you were to consider only this model (and not the more general case, in which the demand for money depends both on the interest rate and on the level of income), you would think that fiscal policy could not affect, within the framework suggested by the model IS-LM, at the income level. It is also worth noting another of the great models, the rigid price model or Keynes.

To overcome these limitations, attempts are made to make models that include more and more variables and assume more generic relationships between them, but such models are increasingly difficult to study, or to use to predict or explain the economy, than in the case of the more simplified versions. But the simplest versions, by their very nature, tend to fail and fail to forecast economic events or correctly predict the values that economic variables will take. A typical example is that of monetary policies that, in the past, were taken to reduce inflation: it was thought that if the money supply was reduced by a certain level, the price level would decrease approximately by a level predicted thanks to a model used. But most of the time, it was not the reduction as much as had been desired by the monetary policy makers.

- Classical Economy and Classic Model

- Neoclassic Economy and Neoclassical Model

- Keynesian model

- Neoclassical Synthesis or Neokeynesianism

- Recent developments in classical school

- Monetarism

- New classic economy

- Theory of rational expectations

- Recent developments in Keynesian school

- New Keynesian Economy

The creation and study of a macroeconomic model

Most of the time, macroeconomic models are created and studied using mathematical techniques. When the model tries to deduce the qualitative relationship between certain economic variables, linear equations are often used that try to capture the first order effect between the relationship of variables. This type of model frequently includes a large number of assumptions that are not always explicit and that can be hidden behind deceptively simple equations.

Models that attempt to simulate real systems and not simply try to formalize relationships between variables frequently resort to multiple linear regression studies. In that what is intended is to find out the effect of small percentage changes in the input variables. Obviously, for large changes, the model could be non-linear and the predictions of a linear model be invalid, since these, like a first-order Taylor series, only predict first-order effects.

Checking the validity of a macroeconomic model

This can also become a great model for the daily life of entrepreneurs and people starting jobs.

A macroeconomic would not serve to demonstrate reality if its validity could not be verified using the real values of the variables that we are considering, just as it would not be of any use to us to assume what are the relationships between the variables and what are the values of the parameters that influence those relationships, if we cannot verify to what degree those relationships are so and what the values of those parameters would really be. For this reason, a statistical technique called Econometrics is used to check to what extent, using values obtained from reality (for example, from studies carried out by Central Banks, various economic reports from government institutions, and others) it can be verified in which degree what is stated by a model is fulfilled.

For example, if, within the framework of a hypothetical model, we have assumed that consumption (C) depends on income (Y), interest rates (I), accumulated wealth (W) and the price level (P), we could express this as:

C=C0+cAndAnd+cII+cWW+cPP{displaystyle C=C_{0}+c_{Y}Y+c_{I}I+c_{W}W+c_{P}P,}

(Which would be a linear relationship). The values of C, Y, I, W and P would have to be found by looking for official economic reports that could show us these statistics and the values they have taken over time (for example, the values they have taken each year for a period of time). 10 years), but the values of the parameters (cy, etc.) would have to be derived by the researcher using econometrics. This technique can also inform to what extent this linear model is valid (that is, that it would succeed in explaining the value of C based on the remaining variables) or if any of these variables is irrelevant, or if they are altogether insufficient to explain the value of C throughout the period considered.

In some cases, it is intended that the macroeconomic models have a microeconomic foundation, that is, that the macroeconomic variables involved can be represented as the sum of microeconomic variables that fluctuate in the equilibrium relationships of various microeconomic models that represent the economic agents operating in the area being studied. If this is not done, we would have a macroeconomic model based on more or less arbitrary beliefs about the functioning of the economy, which is an "ad-hoc" model.

Contenido relacionado

ISO 4217

Sticks of the border

Monetiform

![{displaystyle Y={frac {1}{h[1-c(1-t)]+bk}}left[h(I_{m}+G+X_{N})+{frac {Mb}{P}}right]}](https://wikimedia.org/api/rest_v1/media/math/render/svg/177bc5781c4f4114ab0b3b96f96db7e5b1915aea)

![{displaystyle Y={frac {1}{h(1-c)(1-t)+bk}}left[h(I_{m}+X_{N})+{frac {Mb}{P}}right]}](https://wikimedia.org/api/rest_v1/media/math/render/svg/9c02d4a4513d9dfb446787c89d4c05594bf5de12)