Hyperinflation

In economics, hyperinflation is very high inflation, out of control, in which prices rise rapidly at the same time that the currency loses its real value and the population has an evident reduction in his monetary heritage.

The definition used by most economists is "an inflationary cycle with no tendency to equilibrium." A vicious circle is created in which more and more inflation is created with each repetition of the cycle. It becomes visible when there is an unstoppable increase in the money supply or a drastic debasement of the currency, and is frequently associated with wars (or their consequences), economic depressions, and social or political upheavals.

Almost all hyperinflations have been caused by government budget deficits financed by currency creation. Hyperinflation is often associated with some kind of stress on the government budget, such as war or its aftermath, sociopolitical upheavals, a collapse in aggregate supply or one of export prices, or other crises that make it difficult to collect tax revenue from part of the government. A sharp decline in real tax revenue coupled with a strong need to maintain government spending, coupled with an inability or unwillingness to borrow, can drive a country into hyperinflation.

Features

Ludwig von Mises in his book The Theory of Money and Credit, published in 1912, explained the mechanism of inflation and the extreme cases of monetary destruction or hyperinflation.

In 1955, Philip Cagan wrote The Monetary Dynamics of Hyperinflation, generally considered the first serious study of hyperinflation and its consequences. In it, he defined hyperinflation as monthly inflation of at least 50%.

International Accounting Standard No. 29 describes four indicators of possible economic hyperinflation:

- The general population prefers to maintain its wealth in non-monetary goods or in a relatively stable foreign currency. Any amount in local currency is immediately invested to maintain purchasing power.

- The general population considers monetary amounts not in terms of local currency, but in terms of a relatively stable foreign currency. Prices may be set in foreign currency.

- Credit sales and purchases are made at prices that compensate for the anticipated loss of purchasing power during the credit period, even if this period is short.

- Interest rates, wages and prices are linked to a price index and cumulative inflation for three years is about 100 % or exceeded.

Ultimate causes of hyperinflation

The cause of hyperinflation is a rapid and massive increase in the amount of money that is not supported by growth in the production of goods and services. This results in an imbalance between the supply of and demand for money (including currency). and bank deposits), accompanied by a complete loss of confidence in money, similar to situations in which customers of a bank withdraw their money simultaneously. The passage of legal tender laws and price controls to prevent the loss of value of paper money relative to gold, silver, currency, or commodities, fails to force the acceptance of paper money that has no intrinsic value. If the entity responsible for printing money encourages excessive printing of money, with other factors contributing a reinforcing effect, hyperinflation usually continues. Often the entity responsible for printing money cannot physically print paper money faster than the rate at which it is being devalued, thus neutralizing its attempts to stimulate the economy.

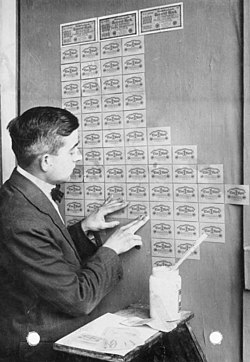

Hyperinflation is generally associated with paper money because the means to increase the supply of paper money is the simplest: add more zeros to the plates and print, or even stamp, old bills with new numbers. There have been numerous bouts of hyperinflation, followed by a return to "hard currency." Some economies in the past reverted to hard currency and barter when the medium in circulation devalued excessively, usually after a precipitous withdrawal of the store of value.

Hyperinflation effectively removes the purchasing power of public and private savings, distorts the economy in favor of extreme consumption and the accumulation of real goods, causes the country's flight of the monetary base, and makes the affected area anathema to the investment. Hyperinflation is dealt with drastic remedies, both by imposing public spending reduction shock therapy and by altering the base of the currency. An example of the latter is putting the nation in question under a currency council like the one in Bosnia-Herzegovina in 2005, which allows the central bank to print only the amount of money it has in foreign currency reserves. Another example is the dollarization of Ecuador, officially started in September 2000, in response to the loss of a massive 75% of value of the sucre in early January of that same year.

Another way to combat or be able to deal with an economy with high degrees of inflation, is to quote in a generally stable foreign currency, without using it. For example, an Ecuadorian car salesman quotes in US dollars, even if he is paid with sucres, since the current exchange rate will be used and thus avoids negotiating new prices. This method is called indexing, because foreign currencies they are also adjusted for local inflation.

Among the causes analyzed in light of the historical cases of hyperinflation, we can also name:

- An exceptional political context (international war, civil war, disaster, economic crisis, etc.);

- A very high level of accumulated public debt;

- Impossibility of honouring debt service;

- The low level of taxation of households and enterprises;

- Lack of transparency in public accounts;

- The absence of exchange regulations;

- The loss of confidence of international financial actors;

- The impossibility of the State borrowing abroad;

- Uncontrolled multiplication of agents producing means of payment;

- Systematic indexing of wages, interest rates and price increases;

- A dramatic fall in the level of savings;

- Lack of sufficient security locks (emergency regulations, stop prices, bank closures, price controls, etc.).

This list is not exhaustive and none of these causes is more decisive than another because, in the context and situation, each case of hyperinflation seems to be unique. Nor are they mutually exclusive. For example, the hyperinflation of the Weimar Republic is partly due to scarcity, but also due to German borrowing which pushes Germany to print money (strongly increases the money supply, eventually (and there are no other factors)) as the wages are indexed to inflation, they rise sharply, giving rise to a vicious circle. In Zimbabwe, inflation was also due to a shock of money creation (to pay debts and finance the state) but also the confiscation of white land from managers close to power, but not good managers: there has been a sharp drop in production (supply shock).

The consequences of hyperinflation are equally complex. Since hyperinflation has always been a traumatic experience for the area that suffers from it, the next regime almost always puts in place policies to prevent its recurrence. Often this involves making the central bank very aggressive in maintaining price stability as is the case with the German Bundesbank, or moving towards some hard monetary base such as a currency board. Many governments have passed extremely strict price and wage controls as a result of hyperinflation, which is in effect a forced form of saving.

Models of hyperinflation

Because hyperinflation is visible as a monetary effect, hyperinflation models focus on the demand for money. Economists see both a rapid increase in the money supply and an increase in the speed of exchange of money if inflation does not stop. Either of these two, or both, are the ultimate causes of inflation and hyperinflation. A dramatic increase in the velocity of exchange of money as the cause of hyperinflation is central to the "confidence crisis" model of hyperinflation, where the risk premium that sellers demand for paper money over face value rises rapidly. The second theory is that there is a radical increase in the amount of medium of exchange in circulation, which can be called the "monetary model" of hyperinflation. In both models, the second effect follows from the first: low confidence forces an increase in the money supply, or too much money destroys confidence.

Hyperinflation is a positive feedback loop of rapid monetary expansion. It has the same cause as other types of inflation: money-issuing institutions, central or not, produce currency to pay for spiraling spending, often due to sloppy fiscal policy, or rising military spending. When sellers perceive that the issuing entity has committed to a policy of rapid monetary expansion, they raise prices to cover the expected fall in the value of money. The issuing entity must then accelerate its expansion to cover those prices, which reduces the value of the coin more quickly. According to this model, the issuing entity cannot prevail and the only solution is to abruptly stop the expansion of the currency. Unfortunately, the end of the expansion could cause severe financial trauma to those who used the currency as expectations were suddenly adjusted. This policy, combined with cuts in pensions, wages, and government spending, were part of the Washington consensus of the 1990s.

Quantitative equation of hyperinflation

One explanation for the increase in the general price level in hyperinflation is the Irving Fisher quantity equation:

- Number of transactions⋅ ⋅ price level=offer of money⋅ ⋅ speed of circulation{displaystyle {text}{transaction number}cdot {text{price level}=}{text{money supply}}}{cdot {text{transit speed}}}}}}}}}

This formula can be transformed into:

- price level=offer of money⋅ ⋅ speed of circulationNumber of transactions{displaystyle {text{price level}}={frac {{text{oferta de dinero}}}cdot {text{transfer speed}}{text{number of transactions}}}}}}}}}}

Therefore, the price level increases accordingly et alii

- Proportionate to the monetary supply (if, for example, the central bank issues more money, but the speed of circulation and the number of transactions remain unchanged);

- Equally proportional to the speed of circulation, if the amount of money and the number of transactions remain unchanged;

- Also proportional to the reciprocal number of transactions (e.g., in the case of an interruption of the economic cycle due to disasters; as another example, when the delivery capacity is suddenly broken, but the demand remains, with the rates of circulation and unchanged money).

Hyperinflation in Africa

Zimbabwe

Hyperinflation in Zimbabwe has persisted since the early 2000s, shortly after the Zimbabwean government's confiscation of white minority farmland and its refusal to pay debts to the International Monetary Fund. Data from November 2008 estimated Zimbabwe's annual inflation rate to be 89.7 trillion percent (i.e. prices doubling every 24.7 hours). In April 2009, Zimbabwe stopped printing the Zimbabwean dollar, causing the South African rand and the US dollar to become the standard currencies for exchange. The local currency has disappeared and in 2014 only US dollars and South African rands circulate on the streets.

Hyperinflation in America

According to economist Steve Hanke, Latin America has historically been affected by high levels of inflation, but very few incidents of hyperinflation. Among the few registered cases is that of Argentina in 1990; Brazil in March 1990, with a monthly inflation of 82.4%; Bolivia in September 1985, which reached 183% per month, and close to 60,000% per year; Peru, in August 1990, reached 397%.; and the contemporary case of Venezuela that began in 2015.

Argentina

In 1989 with the devaluation of the Austral in Argentina, thousands of people fell into poverty: hyperinflation devoured salaries, generated riots, looting and led to the advancement of the transfer of power. Hyperinflation caused an increase in the percentage of people living in poverty from 25% at the beginning of 1989, to the historical record of 47.3% in October of the same year. At the end of 1989 Javier González Fraga would be appointed head of the Central Bank during his administration (July 8, 1989-November 24, 1989) the Argentine hyperinflation of 1990 broke out, which had economic implications since it affected the entire productive system and the society; In addition to the high external and internal indebtedness, stagnation, little investment in capital goods and infrastructure, and a serious fiscal imbalance; the loss of value of the Austral currency was added, carried out by the Central Bank in 1989, when hyperinflation of the country broke out. 3079% per year. That year, the US dollar rose 2038%, and he was put back in charge of the Central Bank in March 1990. In his second administration, he opposed convertibility and promoted the free and floating exchange rate. After a few months of new management at the head of the central bank, his measures once again unleashed a new hyperinflationary process. Months later, the economist Jorge Born accused him of being responsible for the second hyperinflation in Argentina.

Periods of hyperinflation occurred in Latin America in the period 1975-1995 due to the debt crises that affected most of the countries in the region. Subsequently, isolated events such as the financial crisis in Mexico of 1994-1995 and the crisis in Argentina of 2001-2003 brought periods of high inflation.[citation needed]

In July 2018, the national economy of Argentina was described as hyperinflationary by a United States regulatory body, linked to the Security and Exchange Commission (SEC), which ordered that Argentina deserves that classification for having accumulated in the last three years more than 100 percent inflation, based on the International Financial Reporting Standards (IFRS), which regulate the presentation of balance sheets of companies listed on the Stock Exchange worldwide.

Brazil

It occurred during the PMDB (Brazilian Democratic Movement Party) government of President José Sarney, in which inflation skyrocketed days after the legislative elections, launching the "Bresser Plan" in June 1987, which tried to stop double-digit inflation by eliminating subsidies and raising taxes to combat the deficit while developing public works and removing the "wage trigger" of 1986. However, the Bresser Plan failed and inflation continued to rise. This process culminated in the decree of the moratorium on the payment of the foreign debt that the Brazilian government could no longer continue to pay, a provision issued on January 20, 1987. Given this new failure, the "Summer Plan" on January 16, 1989, creating a new currency: the cruzado novo, as a reply to the accelerated devaluation of the cruzado; the Summer Plan tried to stabilize the economy by resorting to adjustment, without success in combating inflation. At the end of the Sarney government, Brazil is in a hyperinflation crisis: between the months of February 1989 and March 1990, the rise in prices reaches 2751% annually and 86% monthly.

In the early 1990s, fiscal problems worsened and led the president of the time, Fernando Collor de Mello, to implement strong measures to reactivate the economy. These included the privatization of public companies, the liberalization of exchange controls, and the suppression of government bodies. This did not generate the expected results and inflation resumed its growing rhythm, registering all-time highs in 2075.

In 1992 the government of Itamar Franco ordered a free market policy, Brazil was plunged into a serious economic crisis, with galloping inflation that had reached 1100 in 1992 and would be 2477 the following year.

Bolivia

In the 1980s, Bolivia suffered the highest inflation in Latin America; in 1984 it reached a hyperinflation of 2177% and in 1985 of 8170%. These figures destroyed the productive structure of the country, as well as the economy in general.

Nicaragua

Between 1984 and 1985, with a duration of 18 months, Bolivia reported a cycle of hyperinflation that totaled 23,454, while Nicaragua, with 58 months of hyperinflation between 1986 and 1991, added 13,109 and Venezuela, with 12 months completed, exceeded 980,000.

Peru

At the end of the 1980s, a strong inflationary escalation in Peru was added to the strong economic crisis,[citation needed] in addition to the hyperinflation that occurred during the first Aprista government 1985-1990 and the Fujimori government. In the midst of economic stagnation, on August 8, 1990, the Fujimori government announced an economic shock, known as Fujishock: the exchange rate devalued by 227%, inflation reached 7,694.6 % and the price of gasoline shot up by 3000. For the rest, most Latin American countries in the 21st century have had inflation rates normally between 5 and 10%.

Venezuelan

Venezuela began a long period of continuous and uninterrupted inflation since 1983 with two-digit annual percentage rates; although between 2006 and 2012 the government of Hugo Chávez reported the lowest inflation rates of the entire period, which began to grow again at double digits in 2013 and 2014.

But it will be in 2015 when rates reach above 100%, unleashing hyperinflation. If a comparison is made between the period of 2007, when the currency exchange (Bolívar Fuerte) was introduced, until mid-2016, some products such as meat reported increases of up to 8,600%, limited by government controls and a rise uncontrolled "parallel dollar", which is the bolivar-dollar exchange rate that is made outside of the one established by the government of Nicolás Maduro. Meanwhile, the Central Bank of Venezuela devalued the Bolívar by 368.7%, passing it from 762 Bs/$ to 2,810 Bs/$, thus reporting an inflation rate of 799.9% with a rise in food and medicine prices every 18 days.. The country is facing the impact of the fall in oil prices with a recession since 2014, a dramatic fall in its imports, an acute shortage of food and medicine, and strong political and social turmoil.

In 2017 inflation was 2,616%, for 2018 the International Monetary Fund projected Venezuelan inflation at 1,370,000% and at 10,000,000% for 2019. It is the largest hyperinflation an American country has ever suffered, depicting an economic crisis similar to that of Germany in 1923 or Zimbabwe in the late 2000s.

The inflationary process in Venezuela has led to two currency exchanges. On January 1, 2008, the bolivar (VEB) was replaced by the bolivar fuerte (VEF) at a rate of 1,000 Bs - 1 Bs.F. and on August 20, 2018, the bolívar fuerte (VEF) was replaced by the bolívar soberano (VES), at an exchange rate of 100,000 Bs.F. - 1 Bs.S. That is, in just over 10 years the original bolivar has been replaced at a rate of 100,000,000 Bs = 1 Bs.S. (one hundred million bolivars are one sovereign bolivar).

The first symptoms[citation needed] of continued inflation began in the late 2000s when on March 6, 2007, the Central Bank of Venezuela and the The Executive Power approved a monetary reconversion that entered into force on January 1, 2008 with the publication in the Official Gazette No. 38,638 at the initiative of former President Hugo Chávez, after reaching high levels of devaluation that set the exchange rate up to 4,254.11 bolivals. per US dollar at the time. As part of the reconversion processes, the denomination, design and valuation of the working capital are changed. During this period, the legal tender of the denominations existing before the reconversion and the new species was allowed, understanding that the previous coins and bills, as well as any other title, trade effect, fiscal impositions and commercial actions (such as checks, bonuses, salaries, taxes, shares, among others) had to be expressed and traded by dividing their nominal value by one thousand, which was the reconversion factor. Otherwise, the bolivar (Bs.) became identified as Bolívar Fuerte (Bs.F), and the ISO code was changed from VEB to VEF.

According to unofficial measurements by the financial consultancy Econometrica, in October 2017, Venezuela registered inflation of 50.6% compared to the previous month, which would exceed the minimum hyperinflation threshold, defined as an increase of prices of 50 % in a month. The financial analysis firm, Econometrica, highlighted a "historical maximum" of inflation in the history of that country, which is going through a serious humanitarian crisis marked by the scarcity and high cost of basic products such as food or medicine, in addition to a shortage of paper money., which forces citizens to stand in long lines at ATMs to withdraw the little cash that banks receive, also asserts that Venezuela would have been fully complying for years with the conditions that would usually lead to hyperinflation, among which the uncontrolled issuance of money stands out. by the Central Bank and the decline in goods on the market due to the drop in production and the closure of approximately 12,000 companies.

On November 1, 2017, the fifth increase in the minimum wage of that year took place, and the thirty-ninth that began the so-called Bolivarian Revolution in 1999. In this way, the monthly minimum wage of Venezuelans stood at 177,507 bolívares, an amount that was equivalent to 53.07 dollars according to the official exchange rate of reference (3,345 bolívares per dollar) and 4.30 dollars at the exchange rate then applied on the black currency market.

The year 2017 closed with inflation of 2,616% as determined by a specialized commission of the National Assembly, with an opposition majority, in 2018 the International Monetary Fund estimated that inflation could reach a maximum of 1,350,000%.

"We project inflation to burst to 1,000,000% by the end of 2018, to indicate that the situation in Venezuela is similar to that of Germany in 1923 or Zimbabwe in the late 2000s", said the IMF's chief economist for Latin America, Alejandro Werner.

The Finance Commission, in the absence of figures provided by the Central Bank of Venezuela regarding inflation, has calculated that after ten days of the government's political package, hyperinflation in Venezuela has skyrocketed. Only in the month of August it reached 223.1%, while the accumulated from January to August 2018 was 34,680.7% and the annualized (from August 2017 to August 2018) is already at 200,005%” and daily inflation is 4%.

By November 2018, it became the worst in the history of Latin America with around 980,000. The prices of products in the single oil producer country rise at a rate of 3 or 4% per day and each month the inflation rate touches or exceeds 200%, a situation that leads Venezuelans to live in eternal tension. During the first six-year term of government of Nicolás Maduro, accumulated inflation between 2013 and 2019 in the country was 5,395,536,286%. By the end of 2019, accumulated inflation remained high with 7,374.4% according to the National Assembly.

In 2022, Venezuela emerges from the hyperinflationary period.

Hyperinflation in Asia

Chinese

As the first user of fiat currency, China was also the first country to experience hyperinflation. Paper money was introduced during the Tang dynasty, and was generally well received. It held its value, as successive Chinese governments established strict controls on issuance. The convenience of paper money for commercial purposes led to a strong demand for paper money. It was only when discipline in the quantity supplied was broken that hyperinflation arose. [29] The Yuan dynasty (1271–1368) was the first to print large amounts of fiat money to finance their wars, resulting in hyperinflation.

Many years later, the ROC suffered a hyperinflation of 1948–49. In 1947, the highest denomination bill was 50,000 yuan. In mid-1948, the highest denomination was 180,000,000 yuan. The 1948 currency reform replaced the yuan with the gold yuan at an exchange rate of 1 gold yuan = 3,000,000 yuan. In less than a year, the highest denomination was 10,000,000 gold yuan. In the last days of the civil war, the silver yuan was briefly introduced at a rate of 500,000,000 gold yuan. Meanwhile, the highest denomination issued by a regional bank was 6,000,000,000 yuan (issued by the Xinjiang Provincial Bank in 1949). After the renminbi was instituted by the new communist government, hyperinflation ceased, with a revaluation of 1:10,000 Renminbi in 1955.

- Start date and completion: July 1943 - August 1945.

- peak month and inflation rate: June 1945, 302%.

- Start date and completion: October 1947 - mid-May 1949.

- Mes peak and inflation rate: April 5.070%.

Hyperinflation in Europe

Germany (Weimar Republic)

After World War I, which caused chaos in the world economy, the Treaty of Versailles forced the losers to indemnify the victors. The inability to pay reparations was one of the causes of hyperinflation in Germany. This reached the figure of 1,000,000,000,000% in 1923 during the French occupation of the Ruhr. The countries of the dismembered Austro-Hungarian Empire also suffered high doses of inflation and various currency crises as the government in Vienna accelerated the printing of Crowns to supplement its dwindling tax revenues.

Hungary

The world record for hyperinflation was reached in 1946 in Hungary when it reached 41.9 trillion percent.

The worst hyperinflation in history occurred when the Kingdom of Hungary, which had been an ally of Nazi Germany since 1941, was invaded by the USSR in the fall of 1944. After full occupation ended in 1945, 60% of Hungary's economy had disappeared and the country was in a process of transition towards a socialist economy. The currency of that time, the pengő, suffered the greatest loss of value in history. As soon as the war ended, in the summer of 1945, 10 million pengős bills were already circulating, so the government created a new currency, called adópengő, whose initial value on January 1, 1946 was 1 adópengő = 1 pengő. Six months later, the adópengő was worth 2,000 trillion pengős. At that rate, product prices doubled every 15 hours. The daily inflation rate was 207%. A 100 trillion pengő note was printed. pengős (a 1 followed by 20 zeros). A pengő was equal to only one thousandth of a dollar at the time. Eventually, the government created a new currency, the forint (also known as the Hungarian forint), whose exchange rate was 1 forint = 400,000 quadrillion pengős (a 4 followed by 29 zeros).

Serbia

In those years, due to the disintegration of Yugoslavia produced by the Yugoslav wars and in which Milosevic's Serbia was a key factor, one of the greatest hyperinflation phenomena in history occurred:

[...]The situation became very critical in the second half of 1993, when inflation entered an exponential growth stage until marking the rate of 310,000 per cent at the end of December, placing the rate for the whole of the year at 178,000 per cent. That year, 500 billion dinars were printed. Beginning the fourth week of 1994, inflation, out of control, reached the fantastic value of 5,000.000.000.000.000. In other words, product prices doubled every day. The crisis of the Yugoslav dinar surpassed the famous collapse of the German framework in the years of the Republic of Weimar in 1922-1923. The inflationary nightmare ended from January 24, 1994, with the circulation of the new Yugoslav dinar, convertible and adjusted in parity with the German framework, within the stabilization plan developed by the director of the National Bank of Yugoslavia, Dragoslav Avramovic. A new dinar amounted to approximately 13 million units of the former dinar, which had been revalued four times since January 1990, the latter only a few days ago, on 1 January 1994. In addition to the successive revaluations of the monetary nominal, mere artifices to try to annul hyperinflation, it turned out that a new dinar of 1994 was 1,300 quadrillions (one 1.3 followed by 26 zeros) of dinars prior to 1990.

Periods of hyperinflation in the world

Between 1900 and 2019 there have been startling cases of hyperinflation, usually calculated on a monthly basis. As a historical indicator, the French Revolution produced monthly inflation of 143% during the seven-year period between 1789 and 1796. [citation needed]The record loss of value Most of the money falls on Hungary in the period immediately after World War II, when inflation reached a daily ceiling of 207% in 1946.

Hyperinflation process

Hyperinflation processes are characterized by following a pattern that can be described, in a simplified way, as follows:

- Expansion and bubble: Economic growth, boom of markets and asset valuation bubbles.

- Contraction and crisis: Panic in the financial sector, economic contraction, negative inflation. Reaction Central Banks: reduced interest rates, monetary injections.

- Bubble and debt: Expansion of public and corporate debt. Exceptionally low interest rates.

- Stabilization: Recovery of asset markets, debt stabilization, decline in volatility.

This is the end of the recurring business cycle (1-4-1) (TACE). However, on occasions, when the debt bubble is especially large, or central banks overreact too much, the scenario evolves towards:

- Bubble burst: Inflation becomes massive, it decreases debt demand, central banks intervene buying debt. Expulsion of private investors, rise of corporate debt returns, public debt crisis.

- Currency crisis: Inflated currency escape, vicious circle and devaluation or depreciation..

- Accelerated inflation: Inflation reaches pre-crisis levels, and continues to rise rapidly as the devaluation of the currency increases imports and the outflow of debt funds floods the liquidity market while the supply of goods continues to decline. Raw materials and consumer goods prices rise.

- PNR: Central banks do not contract monetary supply, public spending continues to grow, deficits increase while the real economy remains depressed and prices are triggered. Inflation reaches double-digit growth and triggers a flight to real property.

- Monetary destruction: Inflation Spiral, Currency Devaluation, Bonus Market Crisis.. Reduction of monetary demand, loss of confidence in the currency... prices grow geometrically... finally not even a monetary contraction is effective as the demand for cash is evaporated.

- A strong monetary contraction, Volcker style (1975) or Mises (1922), before the point of no return can stop the spiral[chuckles]required], however, will produce side effects such as: recession, strikes, unemployment, lost elections and unpopularity.

The Olivera-Tanzi effect

Inflation also affects the real value of tax collection when there are significant lags in tax collection. The problem is that the obligation is defined on a certain date, but the payment is made later. In many countries there is no mechanism that preserves the real value of the tax liability during the lag. Consequently, an increase in the inflation rate during this period reduces the real value of tax collection. This phenomenon is known as the Olivera-Tanzi effect (after its discoverers Julio H. G. Olivera and Vito Tanzi) and can become a vicious circle. The increase in the fiscal deficit causes a rise in inflation, which in turn reduces the value of tax collection; reducing the latter increases the fiscal deficit, and so on. This process can cause destabilization. In fact, it was a major contributor to many of the cases of high inflation rates experienced by developing countries during the 1980s.

Evidently, seigniorage (also known as inflation tax) largely replaces taxes and indebtedness as a means of financing the State in periods of high inflation, being both an effect and a cause thereof.

Contenido relacionado

Origins

Charlemagne

Small property