Argentine economy

Argentina's economy is the second largest in South America according to 2020 data, second only to Brazil. Along with Brazil, they are the only South American countries to form part of the G-20, which brings together most of the largest, richest and most industrialized economies on the planet. Argentina has great natural resources and benefits from it —especially from its extensive plains of fertile lands—, it has a sector oriented towards the exploitation and export of advanced technology agriculture, with exports of knowledge-based services (KBS) and technology with a projection of exports of more than 7,000 million in 2022. Considerable development of its nuclear and satellite industry, a diversified import substitution industrial base, considerable scientific-technological development for not being a developed country, and a virtually entirely literate population, with a considerable rate of union affiliation. According to the MSCI country market classification index, Argentina's economy went from being considered an "emerging market" to being part of the "standalone" category. » in 2021.

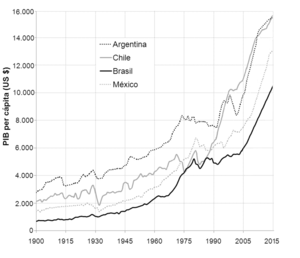

At the beginning of the XX century, Argentina was one of the countries with the best prospects, but at the same time represented just under half of those in Australia and the United States. However, between 1974 and 2002, various economic depressions affected its performance. In 2016, the World Bank classified Argentina as a middle-income economy. In that same year, the country had a per capita income of more than US$16,000 in purchasing power parity (PPP).

According to a UN annual report on Human Development for the year 2016, Argentina is the Ibero-American nation with the fourth highest human development index behind Spain, Chile and Portugal, and ahead of Uruguay.

In exports and imports, in 2020, Argentina was the 46th largest exporter and the 52nd largest importer in the world. In industrial terms, the World Bank lists the top producing countries each year, based on the total value of production. According to the 2019 list, Argentina has the 31st most valuable industry in the world (US$57.7 billion). It is one of the largest soybean producers in the world, after the United States and Brazil, with 48 million tons. in 2011. The country is one of the largest meat exporters in the world and its production has been recognized many times as the best quality. It is the world's leading producer of yerba mate, and is one of the world's 5 largest producers of soybeans, corn, lemons, pears and sunflower seeds, the largest producer of wheat and wool in Latin America, among other crops. It is the largest wine producer in Latin America, fifth in the world and the main biodiesel producer globally. At the continental level, in 2014 it was in fourth place in oil production (after Brazil, Venezuela and Colombia) and has the third largest gas reserve on the planet. The Aguilar Deposit in Jujuy is the highest concentration of lead and zinc minerals in South America and the Bajo de la Alumbrera in Catamarca is one of the largest gold extraction deposits and copper in Latin America, with Argentina being the 13th largest gold producer in the world. Argentina is the largest software producer in South America and ranks second in terms of auto parts manufacturing, after Brazil.

The country maintains an external debt of approximately 120,000 million dollars (2009), equivalent to 38.7% of GDP. The amount of it is mainly due to the operations carried out during the last civil-military dictatorship (1976-1983), a period in which the debt grew by 364% and a massive borrowing from abroad during the two successive governments of Carlos Menem, due to the cheap dollar policy carried out by the convertibility law. In the latter, the growth of the debt was 123%. The relationship between GDP and external debt reached its critical point in January 2002 when it represented 190% of GDP. Since then, a combination of debt reduction, moderation in the taking of new credits and a considerable increase in GDP has reduced the external debt to just under 41.5% of GDP.

Inflation is another of the problems that the Argentine economy has faced. In the country in 2020 an annual inflation of 36.1% was registered, while that of 2019 was 53.8%. Between the years 1945 to 1975, the average annual rate was two digits, with a large triple-digit peak in 1959 (129.5%), and peaks over 30% in 1948 (31%), 1951 (36.7%), 1952, 1966 (31.9%), 1971 (34 7%), 1972 (58.5%) and 1973 (60.3%).

The Argentine population, in a certain way, is accustomed to the ups and downs that from time to time affect the national economy. Its citizens know how to act in the face of new unfavorable situations that later return to normality. Various irregularities in the statistics have led the International Monetary Fund, in an unprecedented measure, to recommend suspending the country's right to vote and other related rights within the agency.

In 2002, during the most critical moment of the crisis, poverty values were close to 54% and unemployment 21.5%. During the following years these social indicators managed to reduce very considerably. In the country, indigence and poverty indices are measured based on information from the Consumer Price Index (CPI) made by INDEC based on the estimation of the Basic Food Basket and the Total Basic Basket. In the first semester of 2012, the poverty index was in the order of 6.5%, being the lowest in Latin America for that year, below Uruguay (6.7%). According to ECLAC (which performs the measurement based on INDEC's own Permanent Household Survey) poverty in Argentina in 2012 was the lowest in Latin America for that year, even below Uruguay (5.7%). In October 2013, INDEC decided to discontinue the publication of the poverty and indigence indicators due to discrepancies in the methodology. In January 2016, after the change of government, INDEC was intervened and modified the measurement methodology, which resulted in a poverty rate of 32.2% being calculated in the second quarter of 2016. This The index placed the country slightly above the average population in poverty in Latin America, 28% according to Cepal. The methodology was criticized by various sectors, who pointed out that for political reasons there was an overestimation of poverty and indigence indices, attributing the situation to the previous administration.

The World Bank considers "middle class" those people who receive an income per day and per capita between 10 and 50 dollars; With this parameter, the World Bank established at the end of 2012 that Argentina had doubled its middle class since 2003, representing an increase of 9.3 million people (25% of the population), being the highest growth in the Region.

Argentina is part of the regional bloc known as Mercosur, made up of Argentina, Brazil, Paraguay, Uruguay and Venezuela, while Bolivia is in the process of accession. Said bloc is the largest food producer in the world, has a GDP of 3.3 trillion dollars, which represents 82.3% of the total GDP of all of South America, and has more than 270 million inhabitants (close to 70% of South America), which makes it the largest, most populous, economically powerful and best integrated bloc in Latin America. As a consequence of the size of the Mercosur economic bloc, trade relations between Argentina and Brazil increased to become of prime importance for both countries. Argentina and Brazil are the two largest, most influential and most economically powerful partners in the bloc, and since the formation of Mercosur there have been numerous clashes between the two South American powers: the trade balance between the two countries began to turn into a deficit for Argentina since June 2003, which was a cause for concern for businessmen and officials in that country. This deficit was reversed briefly in May 2009 and reversed again in 2012, achieving a surplus with Brazil. In 2006, the governments of Argentina and Brazil signed a series of bilateral agreements, among which is the competitive adaptation clause and the agreements referring to commercial exchanges in the automotive sector to reduce the asymmetries present in the bloc. These asymmetries have been the reason for complaints from the smaller countries such as Uruguay and Paraguay, who are at a disadvantage compared to their economically larger partners, Ar Gentina and Brazil and have criticized the tutelage exercised by the latter over the bloc.

Economic history

Colonial period (1580-1810)

In the second half of the 16th century, Upper Peru, Tucumán, and Paraguay, where colonization had concentrated since the indigenous people were numerous and sedentary, demanded the creation of a port in the South Atlantic to establish more commercial ties. close with Spain, reduce isolation and curb the threat of foreign incursions into the Río de la Plata. The Spanish Crown authorized the second foundation of Buenos Aires. In 1573, Governor Juan de Garay founded an intermediate city: Santa Fe and in 1580 he founded the city of Trinidad and Puerto de Santa María del Buen Ayre ―currently known as the City of Buenos Aires― as part of the Viceroyalty of Peru.

During the last third of the 16th century, thanks to the introduction of the mercury amalgamation technique, silver production had doubled, as had the mortality of the indigenous people. The city of Potosí had a population of 160,000 inhabitants and became the main consumer market in Latin America. In this context, Buenos Aires became the natural entry and exit point for products from Alto Peru and Paraguay. On the one hand, inputs and thousands of black slaves entered to replace the dwindling indigenous population, and on the other hand, the silver extracted from the Potosí hill left.

Due to the unauthorized exit of precious metals through the Port of Buenos Aires, in 1594 the king prohibited trade with this port and established that all silver production produced in Upper Peru had to go to Spain through the port from Lima, with some exceptions to avoid shortages for the population: the authorization to charter two boats per year with products from the area (leather, mainly). This situation led to smuggling as the only solution, which became the most profitable economic activity in colonial Buenos Aires.

During the colonial era, the economy of Tucumán y Cuyo was dedicated to the production of inputs and consumer goods for the markets of Upper and Lower Peru, Buenos Aires and Paraguay. They produced wines and brandy from Cuyo, mules from Córdoba, fabrics in Salta and Tucumán, carts from Córdoba and Tucumán, etc. From the economic point of view, Córdoba was commercially linked to Upper Peru; while the Cuyo region was linked to Santiago de Chile.

In the Pampas region, the main economic activity was cattle raising. The origin of cattle farming in the pampas dates back to 1536 ―when Pedro de Mendoza introduced the first horses― and 1580 ―when Juan de Garay introduced between 300 and 500 cattle―.

Since its creation as the Viceroyalty of the Río de la Plata to the present, Argentina is one of the countries with the largest area suitable for the development of agriculture in the world, a fact that has given it comparative advantages. During the 19th century the rural economy was almost completely dedicated to livestock and agriculture.

By the year 1608, there was a large herd of wild cattle in Buenos Aires that multiplied freely in the nearby fields. In 1609, the Cabildo de Buenos Aires agreed to the registration of people interested in participating in the hunting and slaughter of wild cattle, called "vaquerías". Their object was the exploitation of cattle to obtain their leather, discarding the meat. This stage lasted approximately until the middle of the 18th century.

The «Land Law» of 1754 played a fundamental role in the birth of the estancia, to the extent that the action of vacuar served as an antecedent to aspire to property, contributing to the distribution of the latifundistas of the land. When the wild cattle began to decrease in number, it was necessary to go deeper and deeper into Buenos Aires territory. Thus begins the time of the ranches, of branded cattle and a greater use of the animal: the fattening factories and salting houses were born.

The founding of Colonia del Sacramento by the Portuguese in front of Buenos Aires in 1680, came to reaffirm the growth of contraband. The fight between Spain and Portugal over the Río de la Plata continued in 1724, when the Spanish governor Bruno Mauricio de Zavala founded the city of Montevideo to prevent the capture of that bay by a contingent from Brazil.

In the year 1776 Spain created the Viceroyalty of the Río de la Plata, to expel the Portuguese from the Río de la Plata, it covered what is now Argentina, Uruguay, Paraguay, Bolivia and parts of southern Brazil, northern Chile, southeastern Peru, and the Falkland Islands.

With the enactment of the Free Trade Regulations (of 1778, under the Bourbon dynasty), the aim was to protect the commercial interests of peninsular producers in the captive colonial markets. Free trade had disastrous consequences for the interior of the viceroyalty, [citation needed] only some sectors, such as brandy, carts, mounting and transport items, and fabrics of wool, they were able to survive.

In Buenos Aires, the sanction of the Auto de libre internamiento (of 1778) and the Reglamento de Comercio Libre (of 1788) caused a veritable export boom, exceeding 150,000 hides per year (in 1778) to 800,000 (in 1801). From a political point of view, the installation of customs in 1779, of the Consulate of Commerce in 1794 and the establishment of the Municipality System in 1782, consolidated the hegemonic role of Buenos Aires. Aires and the weakening of the power of Lima.

Establishment of the national state (1810-1852)

The May Revolution of 1810 unleashed a wave of changes, when Upper Peru separated from the Viceroyalty, the Río de la Plata was deprived of its main consumer market[citation required] and the region that produces precious metals. The economies of the interior were isolated and stopped fulfilling the binding role between Buenos Aires and Upper Peru, beginning a process of internal migration and depopulation of the northwest. The revolution abolished indigenous servitude and established the freedom of the children of slaves (libertad de wombs).

Once Independence was declared in 1816, the country began to depend on its main buyer and seller: the United Kingdom. In 1827 it was the first episode of debt crisis in history. Argentina went into default in 1827 and its recovery took three decades. The next crisis was the episode known as the Panic of 1890.

In 1828, the Buenos Aires land-owning oligarchy that dominated the Legislature managed to modify the Law of Emphyteusis. Juan José Viamonte fought the clause of the law that prohibited the enfiteutas from acquiring new lands. The State of Buenos Aires for its part "pawned all its effects, assets, income and land, mortgaging them to the exact and faithful payment of the said sum of 1,000,000 pounds sterling and its interest". Consequently, in 1828 it was liquidated. the naval squadron and two frigates that were being built in England were given in payment. Thus, when the Malvinas were occupied by the British five years later, there was no naval force to counter it. Ferdinand White, a British spy sent by Baring Brothers to the Río de la Plata, condemned the criminal aspects of this agreement. Of the sum received, only 4% of what was agreed reached the Río de la Plata in gold, as agreed: 20,678 pounds.

The Buenos Aires landowning class pressured to expand the border, for this purpose in 1820 an expedition was carried out that took the borders to the Sierras Pampeanas and in 1833 the Campaña al Desierto led by Juan Manuel de Rosas expanded the surface up to the Salado river. Thus, the latifundio was consolidated as the main economic unit of the province of Buenos Aires, thanks to livestock production that guaranteed excellent profitability without making too many investments or having abundant labor.

From 1832 to 1850, the customs office of the province of Buenos Aires experienced significant growth, going from 1.2 million silver pesos to 4 million. Showing the growth of the Argentine economy during the period of the Rosas government, where exports of leather, wool and jerky also grow.

During the 1830s and 1840s, the economic expansion of the Argentine Confederation intensified, encouraged by foreign trade. Exports of livestock origin (leather, salted meat, tallow, and wool) and the number of foreign vessels that arrived annually at the Río de la Plata with their products managed to double between 1837 and 1852. The expansion of trade stimulated livestock and saladeril production and the enrichment of the sectors linked to it.

From 1850 the wool boom began: that year the total export of wool reached the figure of 7681 tons; in 1855 it reached 12,454 tons, and a year later, 14,972 tons. By the middle of the 1860s, the ranches dedicated to sheep farming in the province of Buenos Aires covered an area of 16 million hectares; a quarter of them being in the hands of Irish and Scottish immigrants, and a large proportion under the control of Basque immigrants. The total number of sheep in the province reached the figure of 40 million.

Thanks to this, Buenos Aires experienced a notable economic expansion supported by the wool cycle and customs revenues. Meanwhile, the railway network, the first in Latin America, went from 573 kilometers in 1868 to 1,331 km in 1874.

During the presidency of Domingo Faustino Sarmiento, large ports were built, such as those of Zárate and San Pedro. A modern port was projected in the City of Buenos Aires, and some 5,000 km of telegraph lines were laid. In 1891 the Banco de la Nación Argentina was created.

In 1876 the first shipment of frozen meat to Europe was made, and the following year the first cereal exports were made. The extension of the railway network had a great boost during the Government of Nicolás Avellaneda, reaching 2,516 kilometers per end of his term: an increase of 89% in six years. Through the Conquest of the Desert, agriculture in the Pampas went from cultivating some 2 million hectares to more than 25 million, with a similar evolution occurring with meat production. Bartolomé Miter, in 1862, the debt took another leap. He first transferred the commitments of the province of Buenos Aires to the Nation, and then agreed to another loan with the English bank for an additional 2.5 million pounds, to launch into the war with Paraguay. But again, of the £2.5m taken on as debt, the country received only £1.9m due to discounts for 'country risk and fees'. Sarmiento, who succeeded Mitre, also went into debt to continue the war and in order to "arm military forces to suppress the Entre Ríos uprising." At the end of Sarmiento's government, the debt already reached 14.5 million pounds.

In 1835 Rosas assumed his second government. In December of that year, the Customs Law was sanctioned, which determined the prohibition of importing some products and the imposition of tariffs for others. Instead, it kept low import taxes on machines and minerals that were not produced in the country. These protectionist measures notably boosted the domestic market and production in the interior of the country. textiles, tanneries, foundries, dry cleaners, and agricultural products were promoted; all from different regions of the country and strong support for the wine industry. During the Rosas era, a series of exploration and exploitation ventures for mining deposits were developed with varying success, including the Escombreras belonging to the establishment of Vladislao Augier and associates. Also in Chañar Punco, the Capillitas Mine, smelting establishments and elements used for grinding the mineral were also established. On the top of Cerro Bayo to Punta Balasto, such as Fuerte Quemado, for example, where gold alluvium was exploited in 1853. In the surroundings of Río Blanco and Negra Muerta, localities located at the headwaters of the Calchaquí valley and in various other nearby regions in the province of Salta, in the area of the Sierra de Rinconada, Santa Catalina, Coyahuaima, El Toro and Carahuasi, in the province of Jujuy gold and silver minerals were important. The expansion of trade stimulated livestock and salad production and the enrichment of the sectors linked to it. The provincial federal governments would hand over the land free of charge, and would have to build the infrastructure of agricultural colonies. In the Puna, a diversified agriculture adapted to the altitudinal climatic conditions and the greater availability of water was developed, from the arid Puna, passing through the valleys and ravines, cultivating domestic species such as corn, quinoa, potatoes, beans, and various legumes that were exported to Peru and Bolivia. The Confederation benefited from the rapid introduction of technical advances, the first Hereford and Shorthon, the first Merinos and the first Friesian heavy draft horses had been introduced into the country.

Agro-export model (1880-1930)

The ranchers had been strengthened by victory in the long war against the gaucho and were preparing to finance the "war against the Indian" (1878-1885), through which the Argentine Army would annihilate the indigenous peoples that inhabited the pampas and Patagonia, confiscating 10 million hectares (a territory almost equal to Belgium, the Netherlands and Denmark together) that were delivered to 344 ranchers, at an average of 31,000 hectares per rancher, which would translate into complete control of political power by the ranchers and English capital, especially after 1880, with the establishment of an oligarchic regime known as roquismo, of virtually unique party and sustained in the fraud that allowed the sung vote, which would remain in power until 1916.

The agricultural offer constituted the base of the economic development of Argentina in the period 1880-1930. The production of meat and cereals, for the world market known as an agro-export model on which they were forged, from transportation to the political organization of the Nation.

The most influential politicians of that time, such as Sarmiento, Juan B. Justo or Juan Alsina, supported the need to structure the new economic system based on the farm (small and worked by its owner) and not on the ranch (based on the latifundio). The development model based on the farm was relevant above all in the province of Santa Fe, led by Aarón Castellanos, but by the end of the century, the political and economic pressures of the ranchers and the British railways imposed the model of the stay as dominant of the Argentine economic system, closing access to land ownership to immigrants, who turned to the cities.

From 1890 to 1930, through the so-called Conquest of the Desert, Pampean agriculture went from cultivating about 2 million hectares to more than 25 million, a similar evolution occurred with meat production, favored by the emergence of the refrigerator. Argentine exports went from 70 million gold pesos in the five-year period 1880-1884, to 380 million in the 1910s. By the 1920s, they fluctuated around 800 to 1000 million of the same currency.

In the first quarter of the 19th century, the main product exported was beef jerky, while in the middle of the century it was sheep's wool. However, at the end of the century, exports of cereals (corn and wheat), which were previously lower than imports, increased sharply and became the main product of the Argentine primary-export sector. In 1876 the first shipment of frozen meat to Europe was made, and the following year the first cereal exports.

Towards the middle of the 19th century, the Argentine economy began to experience rapid growth due to the export of its raw materials from livestock. At the end of the 19th century and the beginning of the 20th, refrigerated ships were developed that made the transport of refrigerated meat possible. During this period, the Argentine economy faced different crises associated with the external sector, with the debt crisis in 1890 being the one that had the greatest impact. The high level of imports, together with external indebtedness, led to a constant bottleneck in the balance of payments. In 1889, with the fall in export prices, interest and amortization payments came to represent 66.1% of total exports, which began a deep economic crisis that lasted until 1891 and implied a contraction of the gross product. domestic of 11.8 percent. Immigration to Argentina, in turn, was discouraged by the recession and drop in real income in this country. According to Sansoni (1990), the terrible working conditions in agricultural tasks, as well as the characteristic seasonality of these tasks, which left workers without employment for a few months. In the case of the golondrina workers, they returned to their countries of origin at times of low activity.

Between 1870 and 1914, the Argentine economy sustained an average growth rate of more than 5% per year. By 1913, income per capita had reached those levels sustained by France and Germany, very higher than countries today more developed than Argentina, such as Italy and Spain, Foreign trade is the most representative exponent of the evolution of the agro-export model implemented from the 1880s. From 1882 to 1889 there is a marked deficit in the accounts of the country, but from 1889 to 1905 the situation is reversed and there is a trade surplus. The agricultural composition of exported products goes from being 6.7% in 1880-1884 to approximately 60% in 1905-1909. Meats in the same period made up 38.02%

There was an excessive expansion of the money supply and inflation. Doubts began about the country's ability to meet its commitments. Given the depreciation of the paper weight, the government began to sell the gold deposited in the National Bank, in August 1888. At the end of 1889, Juárez Celman tried, through a change of ministers, to calm the situation. At the beginning of 1890 the province of Buenos Aires announced the sale of its railways for 40 million gold pesos, being the largest privatization in history until then. The Government embarked on a renegotiation of the debt with the Baring house and began an operation to save the banking system. The growth of debt, both public and private, translated into an excessive monetary expansion that led to a strong depreciation of paper money, threatening investors' profitability, and paralyzing the entry of new capital. British investors, disturbed by the reports from Buenos Aires, withdrew their capital en masse, leading to an economic crisis known as the Panic of 1890.

Labor market

As of the 1850s, a labor market began to develop (hiring salaried workers), mainly in the province of Buenos Aires. The shortage of labor allowed for high salaries. This facilitated the massive immigration that was sustained every year until World War I. Half of the European immigrants chose to remain in the city of Buenos Aires, their addition to the labor market helping to alleviate the labor shortage in the countryside. Subsequent migrations of natives and foreigners helped ensure a job market for the coastal region's economy.

The process coincided with and was boosted by the great European immigration that began at that time and would last until 1930. The population in 1869 reached a little more than 1.8 million people. By the year 1930, the population it reached 11 million. The appearance and development of a labor market allowed the subsequent appearance and development of a considerable labor union organization, which promoted the rise in wages and the improvement in the living conditions of workers.

Foreign investment

Like European immigration, foreign investment played a central role in the economic development of Argentina. Before World War I, capital investment was mainly foreign capital investment. Argentina was an atypical case for foreign investment, differentiating itself from the rest of the Latin American countries, since in the period 1873-1923 the country concentrated 71% of the foreign investments in the region.

The United Kingdom, France and Germany invested considerable sums of money in the development of the country. Foreign funds were placed in export-oriented sectors; railways in particular were built with foreign capital, between 1887 and 1914 alone, the length of the railway network had increased by approximately 5 times: from 6,700 km to 35,500 km. its capital by foreign direct investment. The country experienced an average annual growth of 3.4% during the period 1875-1913.

Situation after the First World War

After World War I ended, US capital and Wall Street began to figure prominently on the international sphere. Argentine economic growth before 1914 was achieved by exports to Europe. First beef and then grains were shipped to Europe, with a booming population. European countries found themselves increasingly in need of importing food products from Argentina.

In 1915 the decision of the Bank of England to increase the interest rate caused the reversal of the flow of foreign capital to Argentina and prevented it from financing the deficit in its balance of payments. The imbalance in the balance of payments deepened as a result of the meager harvest of 1913-1914. Thereafter, the Argentine economy slid into a deep recession. The transmission mechanisms of the crisis were two: the outflow of gold abroad and the fall in primary exports. Within the framework of the gold standard, this flight caused a severe reduction in currency, an increase in the interest rate and a succession of bankruptcies of companies and businesses.

Between 1919 and 1929, Argentina's GDP grew at 3.61% per year. The unemployment rate shows a notable increase, reaching 13.7% in 1914, compared to 5.1% in 1912. In 1915 it reached 14.5%, in 1916 it reached 17.7% and in 1917 it reached the 19.4%, with a total of 445,870 unemployed compared to 1,887,981 employed people. The Argentine economy ranked sixth in world GDP in 1928. During the presidency of Hipólito Yrigoyen, YPF was created, directed by Enrique Mosconi. In eight years, oil production was almost tripled, from 348,888 m³ (in 1922), to 872,171 m³ (in 1929).

The global crisis that triggered the collapse of the Stock Market in 1929 marked the end of the export-oriented model of livestock and grain products from the Pampas region.

Industrial model (1930-1975)

After the Crisis of 1929, a new model of economic growth emerged, although different from that of other countries in the region. On the one hand, sectors that export livestock and grain products, represented by large landowners, refrigeration companies and British railways, tried to return to the agro-export model. The Roca-Runciman Pact of 1933 between Argentina and the United Kingdom realized this objective. During the period (1930-1975) the agro-export sector remained without fundamental changes (no agrarian reform was carried out to redistribute the concentrated ownership of the land) and was superimposed on a new industrialization model oriented to the domestic market. The agro-export sector was oriented towards international trade, based on the guidelines of classical liberal economics, with a preponderant presence of the latifundio and a low use of technology and labor, subject to paternalistic labor relations. On the other hand, an import substitution industrialization model began to emerge, based largely on the state sector.

Import substitution industrialization (1930-1945)

During the period 1930-1943, the process of industrialization through import substitution began to accelerate, centered on state-owned companies with strong military influence, such as YPF, Fabricaciones Militares, subsidiaries of large US companies and, above all, a large number of small and medium-sized factories of national capital, especially in the textile sector.

By 1935, there were 40,606 industrial establishments in Argentina, which housed 590,000 workers. That year, for the first time in the country's history, industrial production was greater than agricultural-livestock production.

The industrial sector developed oriented towards the domestic market, with a preponderant presence of the State, based on the Keynesian economic patterns that burst into the United States with the New Deal, and a great demand for salaried labor subject to collective labor relations between labor and capital.

The postwar nationalist economy (1945-1955)

Once World War II ended, and with Juan Domingo Perón in power, the economy took a drastic turn. Inflation rose to almost 19% annually, the highest inflation rate recorded in the country's history. An economic model of import substitution was applied with the objective of encouraging the growth and development of the national industry.

In 1952 the Peronist government decided to completely pay off the foreign debt. In this way, the debtor country of m$n 12,500 million became a creditor for more than m$n 5,000 million. With the foreign exchange accumulated during the war, it was decided to carry out the nationalization of several sectors considered key to the development of the country: the Central Bank, the railways, the ports, etc. In an effort to limit the country's dependence on the international market, government-induced measures such as the nationalization of domestic industry were aimed at encouraging autonomous internal development, while expanding the internal market through classic state policies. of Well-being.

Between 1946 and 1948, a strong impetus was given to the construction of new branches and the expansion of the railway network, which in 1954 reached more than 120,000 kilometers. The founding of large state companies such as the Altos Hornos Zapla). During this stage, progress was made in the metallurgical sector, such as RyCSA (Rosatti and Cristofaro, which produced combine harvesters, steel, automobiles, among others), Siam Di Tella, which produced refrigerators, but also fans, irons, washing machines, and even kneading machines and suppliers for YPF. The agricultural sector was modernized: from the development of the steel and petrochemical industry, modernization and the provision of fertilizers, pesticides and machinery were promoted, so that agricultural production and productivity increased.

During the Peronist period there was a boom in consumption: kitchen sales increased 106%, refrigerator sales 218%, footwear 133%, phonograph records 200% and the sale of of radios 600%, encouraged by the redistributive programs of the Government and cheap credit. Loans to the private sector tripled and interest rates did not exceed 5% per year, loans to agriculture doubled, and loans to industry grew six-fold.

Increased public and foreign investment revitalized the economy, which grew by more than a quarter in the period 1946-1948. These programs, among other things, helped to eradicate tropical diseases in the north and the recurring problem with locusts. Between 1945 and 1948 the economy grew at a record 8.5% per year, while the real wage increased by 46%.

During this period, Argentina grew at rates of more than 5% per year. Through the First Five-Year Plan, a set of important public works were carried out, aimed at modernizing the country's infrastructure, necessary for the accelerated industrialization process. Hydroelectric plants such as Dique Escaba (in the province of Tucumán), Nihuil (in the province of Mendoza), Los Quiroga (in the province of Santiago del Estero) and six dams with plants in Córdoba, six in Catamarca, four in Río Negro and three in Mendoza, the installed power in plants went from producing 45,000 kilowatts in 1943, to producing 350,000 kilowatts in 1952. An important network of gas pipelines was also built between 1947 and 1949 that linked the Patagonian city of Comodoro Rivadavia with Buenos Aires. With this pipeline, gas distribution increased from 0.3 million cubic meters per day to 15 million cubic meters per day, lowering costs by a third.

The Argentine industry benefited from the impossibility of European countries to supply their products to the world market. Industrial manufactures were exported in considerable volumes, mainly to Latin America and the Caribbean. Some of the policies that were adopted at that time were rediscounts, the Export Committee and Industrial and Commercial stimulus, the Industrial Promotion Laws, the creation of the State merchant fleet, the credits of the Industrial Bank (1944) and the nationalization of the Central Bank (1946). Following Keynesian theories, Perón wanted to install the welfare state, increasing social security and improving income distribution, increasing spending and making simultaneous investments in different sectors, such as defense, health, education and housing. Production grew, the increase in exports turned to the expansion of consumption.

Metallurgical and electrical and non-electrical machinery, aimed at being basic industries for the country. Investments were oriented towards taking advantage of the possibilities offered by a large internal market. Argentina came to have during this period the strongest, most modern and competitive industry in Latin America. In addition to founding some powerful Argentine companies, such as Siam Di Tella Automotores. The privileged industrial branches in this second stage of the import substitution process They were the automotive industry, the oil and petrochemical industry, and chemistry. One of the objectives of import substitution industrialization policies was to reduce dependence on foreign markets, typical of the old agro-export model. In order to promote the accelerated industrialization of the country, the entry of foreign industrial capital was encouraged.

Developmental industrial period (1955-1976)

In 1955, when the Aramburu dictatorship – calling itself the “Revolución Libertadora” – overthrew Perón, Argentina was a creditor country and the Central Bank had 371 million dollars in reserves. In 1956, Aramburu took foreign debt for 700 million dollars, which he could not pay, leaving the country on the brink of default.At the end of the dictatorship, Argentina was in default, and the foreign debt was 1800 million dollars. The fiscal deficit that in 1957 was 27,000 million pesos, in 1958 rose to 38,000 million.

During the 1960s and 1970s, a developmental industrial policy was carried out during the presidencies of Frondizi and Illía. During these years, the oil policy promoted by Perón since 1952 was deepened.

In 1958, contracts were signed with US oil companies, which would operate on behalf of YPF, with the purpose of achieving self-supply of hydrocarbons. For the first time in history, the country achieved oil self-sufficiency, and went from being an importer to an oil exporter.[citation needed]There was an investment of 140 million of dollars in the petrochemical industry between 1959 and 1961. The Frondizi government coincided with a period of intense social mobilizations and strikes, which were repressed by the Armed Forces through a plan that bore the name of CONINTES. Unions were also intervened and local supporters were closed.

Frondizi's government suffered great pressure from military power, which came to be imposed by the liberal economy ministers Álvaro Alsogaray and Roberto Alemann. Alsogaray, together with General Thomas Larkin who had been hired by the World Bank, carried out the so-called Larkin Plan, which consisted of abandoning 32% of the existing railways, laying off 70,000 railway employees, and reducing all locomotives to scrap steam powered, as were 70,000 wagons and 3,000 carriages. Demonstrations and clashes took place throughout the country. Frondizi forced workers to compulsively report to work or be detained. President Frondizi resorted to the gendarmerie and the army, giving the military functions of "internal police", and subjecting the railway workers to the Code of Military Justice. The 1962 coup ended with the government of Frondizi, who was replaced by the provisional president of the Senate, José María Guido.

The government of Arturo Illia drew up a National Development Plan for the five-year period 1965-1969, unemployment went from 8.8% in 1963 to 5.2% in 1966, the Minimum, Vital and Mobile Wage laws were enacted, which resulted in an improvement in the income of workers; and the Medicines Law, which lowered its costs and boosted the national pharmaceutical industry, achieving self-sufficiency and even the export of medicines.

However, Illia's plans were aborted after a new coup d'état, carried out on July 28, 1966, which gave rise to a military dictatorship calling itself the "Argentine Revolution". The liberal economist Adalbert Krieger Vasena, revoked the nationalization and capital control measures, and froze salaries and devalued the national currency by 40%. There were sectors that were harmed, such as rural sectors and national businessmen, due to the lack of protection and denationalization. The inflation rate continued its upward march (according to the December wholesale price index of each year, the figures indicate that prices increased 3.9% in 1968, 7.3% in 1969, 26.8% in 1970, 48, 2% in 1971 and 76% in 1972). The provinces of Tucumán, Chaco and Misiones suffered enormously when the tariff protections (installed by the Perón government in 1955) were removed. Different liberal economic measures were applied. Consequently, GDP fell 1.2 percent and wholesale and retail prices increased. Agricultural production decreased considerably, as did the industrial sector that suffered a crisis. Reserves decreased, and fuel imports increased by 300 percent, emphasizing foreign dependence on inputs. Economy Minister Krieger Vasena was replaced by José María Dagnino Pastore. In 1970, in the midst of an economic-social crisis, the dictator Onganía and his minister were replaced, and the dictator Roberto M. Levingston assumed power.

Between 1973 and the beginning of 1976, the stage known as third Peronism took place, where Héctor José Cámpora, Juan Domingo Perón followed one another, and, after his death, María Estela Martínez de Perón. The first economic measure was a price and wage agreement known as the Social Pact, which initially served to reduce inflation and improve real wages. By 1974 inflation had fallen to 30.2%, almost half of the 79.6% in 1972, while unemployment went from 6.1 to 2.5%. GDP growth went from 3.5% in 1969/72 to 6.1% in 1973, and to 6.4% in 1974. After Perón's death in July 1974, there was a drastic turn in economic policy with the appointment of Celestino Rodrigo as Minister of Economy, which led to a crisis known as Rodrigazo.

Civic-military government (1976-1983)

The economic policies adopted since the 1976 civic-military coup d'état by the military governments determined the decline of industrial activity,[citation required] a progressive concentration of wealth and caused the population to lose the standard of living it had achieved in the mid-20th century.[citation needed] The national external debt rose from 7.875 billion dollars to $45,087 million from late 1975 to 1983. The ratio of foreign debt to GDP became one of the highest in Latin America where countries were already saddled with large foreign debts. This meant a serious obstacle for development policies. The military government establishes Argentina as a primary and financial country and not an industrial one. The policies that were applied from 1976 were the devaluation of the currency, the freezing of wages and the liberalization of prices.

In 1978, the plan of Minister José Alfredo Martínez de Hoz showed signs of being a failure as annual inflation reached 160%, and GDP fell by about 3.2% during that year. In 1979 the inflation rate reached 139.7% with a stagnant economy. In addition, a flight of 25% of bank deposits was generated and the four most important banks in the system were liquidated.During his administration, the external debt multiplied six times: from 7 billion dollars to more than 40 billion dollars.

At the labor level, Martínez de Hoz decreed a wage freeze ―causing an unprecedented drop in the population's standard of living―, prohibited the right to strike and intervened all unions. The real wage, from a base of 100 in 1970, had risen to 124 in 1975 (during the Perón government), but in 1976, after the coup, in a single year it fell to 79: it was the lowest level since the thirties (according to ILO data, from 1988). During the first two years of the civil-military dictatorship, the share of wages in GDP fell from 43 to 25%.

Return of democracy

The eighties are considered the "lost decade" for Latin America, Argentina grew at meager rates. In 1983, the country maintained acceptable indicators and according to Orlando Ferreres, unemployment was close to 4%, less than 10% of society was below the poverty line and there were no indigents. However, external indebtedness was a significant problem, with a debt that had gone from 7,875 million dollars in 1975 to 45,087 million dollars in 1983, in addition to the Latin American debt crisis that was taking place at the national level. regional.

In 1985 the Austral Plan was launched, through which a new currency was created and prices were frozen to reduce inflation. The Austral Plan worked well at first, but its effect was short-lived. Between 1989 and 1990, hyperinflation of 5,000% per year broke out, momentarily raising poverty to an unprecedented level of 47.3% of the population of the Greater Buenos Aires agglomeration. This situation led Alfonsín to advance the elections and deliver the position to Carlos Menem six months in advance.

Statistics

GDP growth

| 1980 | 1981 | 1982 | 1983 | 1984 | 1985 | 1986 | 1987 | 1988 | 1989 |

|---|---|---|---|---|---|---|---|---|---|

| 0.70% | - 5.7% | - 3.1% | 3.7 per cent | 2.0% | - 7.0% | 7.1% | 2.5% | -2.0% | - 7.0% |

Total country debt

| 1980 | 1981 | 1982 | 1983 | 1984 | 1985 | 1986 | 1987 | 1988 | 1989 |

|---|---|---|---|---|---|---|---|---|---|

| 12.56% | 21.32% | 35.99% | 46.66% | 40.49% | 60.47% | 55.76% | 72.56% | 59.74% | without data |

Poverty

| 1980

October | 1981

October | 1982

October | 1983 | 1984 | 1985

October | 1986

October | 1987

October | 1988

October | 1989

October |

|---|---|---|---|---|---|---|---|---|---|

| 7.1% | 5.10% | 21.6% | without data | without data | 14.2% | 10.30% | 15.70% | 24.20% | 38.30% |

Unemployment

| 1980 | 1981 | 1982 | 1983 | 1984 | 1985 | 1986 | 1987 | 1988 | 1989 |

|---|---|---|---|---|---|---|---|---|---|

| 3.0% | 5,0% | 4.5% | 5,0% | 5,0% | 6.2% | 6.3% | 6.0% | 6.5% | 8,0% |

The 1990s: liberalization and privatizations

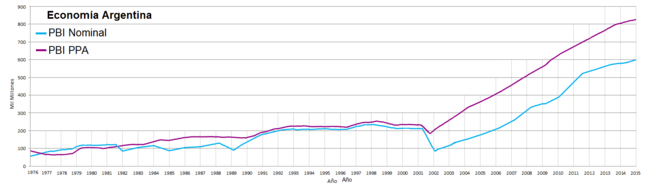

The economic reforms of the 1990s were based on the privatization of public services and the opening of the economy. In 1991, Economy Minister Domingo Cavallo resorted to parity of the peso with the US dollar (Convertibility Law) to deal with hyperinflation, which was very successful and the country also achieved notable growth. Public spending doubled in ten years, especially from the year 1997 and the number of civil servants increased by 40% in the same period.

GDP reached $330 billion in 1998, an increase of 86.8% over 1990, an average of 8.1% per year. Nominal GDP per capita reached $8,300 that same year, the highest during the 1990s in Latin America.

During the validity of Domingo Cavallo's Convertibility Law, due to the exponential growth of public and private debt, especially from 1997 when the course of the economy changed a little after Cavallo's resignation. public spending went from 46,351 million dollars (in 1991) to 82,842 million dollars (in 2001), an increase of 79%, producing a constant and growing fiscal deficit. Despite the fact that President Carlos Saúl Menem sold most of the public companies, the external public debt went from $60,000 million to $105,000 million.

In 1995, due to globalization, the tequila effect caused a retraction of Argentine GDP of 0.9% and an unprecedented increase in unemployment to 16.4% in May 1995. During the 1990s Argentina maintained an average structural unemployment of 11.8% and in October 2001 there were 18.3% unemployed.

This economic model produced economic concentration in the financial, service and agro-export sectors. Poverty measured in the Greater Buenos Aires agglomeration ranged from 33.7% in 1990, 16.1% in 1994, and 26.7% in 1999.

Statistics

GDP growth

| 1990 | 1991 | 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1998 | 1999 |

|---|---|---|---|---|---|---|---|---|---|

| -1,30% | 10,50% | 10.30% | 6.30% | 5.80% | -2.80% | 5,50% | 8.10% | 3,90% | -3.40% |

Total country debt

| 1990 | 1991 | 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1998 | 1999 |

|---|---|---|---|---|---|---|---|---|---|

| 55.82% | 45.62% | 38.45% | 35.94% | 28.89% | 33.69% | 35.57% | 32.66% | 35.20% | 40.10% |

Poverty

| 1990

October | 1991

October | 1992

October | 1993

October | 1994

October | 1995

October | 1996

October | 1997

October | 1998

October | 1999

October |

|---|---|---|---|---|---|---|---|---|---|

| 25.30% | 16.30% | 13.60% | 13.10% | 14.2% | 18.20% | 20.20% | 19,00% | 18.20% | 18,90% |

Unemployment

| 1990 | 1991 | 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1998 | 1999 |

|---|---|---|---|---|---|---|---|---|---|

| 7.6% | 6.5% | 7.1% | 11.6% | 13.3% | 18.9 per cent | 18.8 per cent | 16.8% | 14.8% | 16.1% |

Beginning of the 21st century: Convertibility crisis and explosion of 2001

Main article: Crisis of December 2001 in Argentina

The recurring economic problems led the country into a recession in June 1998 that lasted until 2002. The most critical point broke out at the end of 2001 and caused the end of the Monetary Convertibility Law with important consequences of the economic crisis, political and social. A bank run destabilized the financial system and produced the restriction on the withdrawal of cash, a measure known as corralito. At the end of that year, the country declared the default of the external debt and applied a devaluation of the peso. The crisis reached an unsustainable point on November 29, 2001, when large investors began to withdraw their monetary deposits from banks and, consequently, the banking system collapsed due to capital flight and the decision of the International Monetary Fund to refuse to refinance the debt and grant a bailout. The country risk rose constantly.

In November 2001, Domingo Cavallo and his economic team made up of Patricia Bullrich, Minister of Labor, announced severe adjustments. The general increase in VAT was approved, a 13% cut in pension assets that affected 533,401 retirees, 13% cuts in the salaries of state employees, and a debt worth 3,000 million was issued.

These measures cooled consumption and led to a further drop in employment levels. The fiscal deficit shot up to 4,000 million dollars. Unemployment went from 14.7% in the year 2000 to 23% at the beginning of 2001, levels that marked a historical record in the country, even higher than those of the crisis of 1930. Days later, Argentina entered default.

During this recessive period, the GDP suffered an accumulated loss of 19.5%, registering the greatest decrease in 2002 with a drop of 10.9%. One of the main consequences was the increase in inequality in the distribution of wealth compared to other Latin American countries. At the national level, poverty reached 57.5% of the population, indigence 27.5% and unemployment 21.5%, all record levels for the country.

Statistics

GDP growth

| 2000 | 2001 | 2002 | 2003 |

|---|---|---|---|

| -0.80% | -4.40% | -10.90% | 9,00% |

Total country debt

| 2000 | 2001 | 2002 | 2003 |

|---|---|---|---|

| 42.06% | 49.44% | 152.11% | 128.56% |

Poverty

| 2000

October | 2001

October | 2002

May | 2002

October | 2003

May |

|---|---|---|---|---|

| 40,50% | 45.60% | 60.10% | 65.50% | 62.00% |

Unemployment

| 2000 | 2001 | 2002 | 2003 |

|---|---|---|---|

| 17.1% | 19.2 per cent | 22.5 per cent | 17.3% |

New Keynesian period: The Kirchner government

After a week in which three interim presidents succeeded De la Rúa, in January 2002 the Legislative Assembly elected Eduardo Duhalde as president. Duhalde appointed Jorge Remes Lenicov as his minister of economics, whose first measures consisted of a devaluation of the weight and an asymmetric pesification of deposits and debts. In April of that year, Roberto Lavagna succeeded Remes Lenicov and remained in office during the first years of the presidency of Néstor Kirchner.

In 2003 begins a cycle that continues until 2015 formed by the presidents of Néstor Kirchner (2003-2007) and Cristina Fernández de Kirchner. The economic management of both governments was expansionist, increasing the weight of the state in the economy by increasing public spending associated with social security and restating companies that had been privatized during Menem management.

With a "high-dollar policy", which would allow the production of goods and services at competitive prices in the international market, many industries in Argentina would have begun to cool after the crisis. In mid-2002, signs of economic recovery began to be glimpsed, but the crisis would only be overcome in the third quarter of 2005 when GDP (in constant pesos and prices) exceeded the value of 1998. Indicators such as poverty and unemployment have been substantially reduced since 2002, with poverty values close to 57.5 per cent and unemployment of 21.5 per cent at the most critical time of the crisis in 2002. However, it would take at least until 2010 to recover the per capita income level reached in 1998.

Between 2003/2014 the industry expands 76.1%, showing up to 2011 average annual rates of industrial growth greater than 8%. In industry, trade and services, some 200,000 new companies were created. Between 2003 and 2013 the middle class doubled as a percentage of the total population, which resulted in an increase in that period from 9.3 million to 18.6 million people. At the same time, 6 million jobs were created, reaching an unemployment rate of 6.4 per cent in 2013, the lowest in 25 years.

Two external debt restructurings were carried out in 2005 and 2010, with discounts ranging from 66 to 70 per cent. With regard to the debt contracted with multilateral lending agencies, the debt with the IMF totalled $9810 million in 2005 and in May 2014 it was agreed with the Paris Club to pay $97 billion in default since 2001. According to IMF data, Argentina experienced a reduction of 73 per cent of its external debt over GDP between 2003 and 2013 and became the country with the highest level of debt in the world.Statistics

GDP growth

| 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 10,50% | 10.30% | 6.30% | 5.80% | -2.80% | - 5.9% | 10.10% | 6.00% | - 1.00% | 2.40% | -2.50% | 2.70% |

Total country debt

| 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 45.62% | 38.45% | 35.94% | 28.89% | 33.69% | 53.83% | 42.62% | 38.06% | 39.43% | 42.20% | 43.59% | 52.13% |

Poverty

| 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 49,90% | 44,50% | 37,90% | 36.70% | 34.20% | 33.00% | 31,90% | 28,00% | 27.60% | 27.40% | 32.40% | No data |

Unemployment

| 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 13.6% | 11.6% | 10.2 per cent | 8.5 per cent | 7.9% | 8.7% | 7.8% | 7.2% | 7.2% | 7.1% | 7.3% | 6.5% |

Economic crisis (2018-2020)

Indigence rose uninterruptedly since the first half of 2018: 4.9% (1H-2018), 6.7% (2H-2018), 7.7% (1H-2019), 8% (2H-2019), 10.5% (1H-2020), 10.5% (2H-2020) until reaching a peak of 10.7% in the first half of 2021.

Synthesis and analysis of data 2009 to 2021

From 2017 to 2020, 7,738,724 Argentines became poor. Argentina reached a poverty level of 42.00% in 2020. This level of poverty is the same as that experienced in Buenos Aires in October 2002 (42.3%) (CEPED)

| Year | Population | Poverty | Population in poverty |

|---|---|---|---|

| 2016 | 43.590.368 | 30.30% | 13.207.882 |

| 2017 | 44.044.811 | 25.70% | 11.319.516 |

| 2018 | 44.494.502 | 32,00% | 14.238.241 |

| 2019 | 44.938.712 | 35,50% | 15.953.243 |

| 2020 | 45.376.763 | 42,00% | 19.058.240 |

The microdata from the Permanent Household Survey of the National Institute of Statistics and Census (Indec) indicated that at the end of the last year, poverty reached 42% for the average of the second semester, but that the disaggregated by quarter, processed by experts from the Argentine Catholic University (UCA), reached a level of 45.2% in the October-December period. In this context, a report from the Workers' Statistical Institute (IET), dependent on the Metropolitan University of Workers (UMET) showed that there are almost 20% of people on the verge of falling into that situation.

The study detailed that after experiencing sustained growth throughout 2018 and stabilizing at around 56% between 2019 and early 2020, the outbreak of the coronavirus pandemic led to the proportion of the Population Not Socially Integrated (PNIS), made up of indigents, the poor and people on the verge of falling into poverty, will reach 60% during the third quarter of 2020 after the peak of 66.4% in the second quarter of last year.

Public debt rises again

In 2020, the public debt of the Argentine central government reached 102.79%, levels similar to those of 1989 (109.04%) and 2004 (117.88%).

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|---|---|---|---|---|

| 38,93 | 40,44 | 43,50 | 44,70 | 52,56 | 53,06 | 57.03 | 85.25 | 88.84 | 102.79 | 80.93 |

Non-stop fiscal deficit

Since 2009, Argentina has spent every year in a row with a fiscal deficit, each year more serious than the previous one, reaching -8.59% in 2020.

In 2015, Argentina exceeds the fiscal deficit record of -5.36% of the year 2001, where Argentina experienced the greatest economic crisis in its history, and since that year, even so, the fiscal deficit would reach higher values than the 2001 level sustained until 2020, since in 2021, Argentina would continue with a large fiscal deficit, but at a lower level than in 2001, with -4.33% and -3.49% in 2022.

The IMF projects that Argentina will continue in fiscal deficit until 2027, projecting a total deficit of 12.26% between 2023-2027.

Argentina accumulated a deficit of 47.16% between 2009 and 2022:

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0.35 | -1.83 | -1,39 | -2,75 | -3,02 | -3,25 | -4,25 | -6,0 | -6,65. | -6,69 | -5,44 | -4,40 | -8,59 | -4,33 | -3,49 | -3,32 | -3,49 | -2,56 | -2,03 | -1,49 |

Exaggerated issuance of currency

From May 2003 to November 2022, the amount of liquidity in Argentina multiplied by 201.46 times.

| Chairman | Date | M1 Entry | Date | M1 Departure | M1 Generation |

|---|---|---|---|---|---|

| Néstor Kirchner | May 2003 | 34.667.412 | November 2007 | 107.385.795 | 72.718.383.00 |

| Cristina Kirchner | December 2007 | 123.930.512 | November 2015 | 765.370.263 | 641.439.751.00 |

| Mauritius Macri | December 2015 | 804.666.231 | November 2019 | 1.695.946.438 | 891.280.207,00 |

| Alberto Fernández | December 2019 | 1.952.281.828 | News

(November 2022) | 6.984.423.361 | 5.032.141.533,00 |

Hyperinflation

One way to determine that an economy is in hyperinflation is by following IAS No. 29, which indicates that it is in hyperinflation when accumulated inflation in 3 years approaches 100%.

Applying this rule, Argentina has been in hyperinflation since January 2017, since within the period January 2014 - January 2017 the Argentine economy accumulated 97.65% inflation.

| Chairman | Home | Final | Generation inflation | Accumulated |

|---|---|---|---|---|

| Néstor Kirchner | May 2003 | November 2007 | 41.97% | 41.97% |

| Cristina Fernández | December 2007 | November 2015 | 141.64% | 201.09% |

| Mauritius Macri | December 2015 | November 2019 | 277.95% | 813.31% |

| Alberto Fernández | December 2019 | News

(November 2022) | 294.11% | 3499.47 per cent |

Sectors

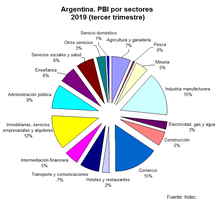

Agriculture and livestock

The production of agricultural foods is traditionally one of the tips of Argentine exports. The Argentine economy is mainly based on the production of grains (cereal and oleaginous) and the chain of soy as a whole (porotes, seeds, oil, food pellets, flour and biodiesel), one of the main productive chains in the country. Argentina is one of the world market leaders of grains, oils and by-products. Agriculture and livestock in Argentina are intensive and in 2018 the sector represented 6.14 % of GDP. By July 2016, the agrarian sector used, together with forestry, hunting and fishing, 337 196 people on a workforce of 17.4 million people, representing less than 2 per cent of the total. As of 2018, 8.13 percent of the Argentine population lived in rural areas, one of the lowest percentages in the world. The Ministry of Agriculture, Livestock and Fisheries is the organization of the national government in charge of the supervision of agriculture.

Argentina is the first world producer of yerba mate, is one of the 5 largest producers in the world of soy, corn, lemons, pear and seed of sunflower, one of the 10 largest producers in the world of grapes, barley, artichoke, tobacco and cotton, and one of the 15 largest producers in the world of wheat, sugar cane, sorghum and grapefruit. Argentina is the third largest producer of soy in the world, with 37 700 000 tonnes produced (it is behind the United States and Brazil); the fourth largest producer of corn in the world, with 43 500 000 tonnes produced (behind the United States, China and Brazil); the twelfth largest producer of wheat in the world, with 18 500 000 tonnes produced; the eleventh largest producer of sorgo, with 1 000 Argentina produces about 2 000 000 tons of sugar with the cane produced. In the same year, Argentina produced 4 100,000 tons of barley, one of the 20 largest producers of this cereal in the world. The country is also one of the largest global producers of sunflower seeds: in 2010, it was the third world producer, with 2 200 000 tons. In 2018, Argentina also produced 20,000 tons of potato, almost 2 000 tons of lemon, 1 300 000 tons of rice, 1 000 tons of orange, 921 000 tons of peanuts, 813 000 tons of cotton, 707 000 tons of onion, 656 000 tons (six hundred and six thousand tons) of tomato, 565 000 tons

In livestock, Argentina is the 4th world producer of beef, with a production of 3 million tons (only behind the United States, Brazil and China), the 4th world producer of honey, the 10th world producer of wool, 13.♪ world chicken meat producer, 23.♪ worldwide producer of pork meat, the 18th largest producer of cow milk and the 14th world producer of chicken egg.

Argentina is one of the 10 largest wine producers in the world (it was the fifth largest producer in the world in 2018). Over the years, the production of fine wines has made great leaps of quality. Mendoza is the largest wine region, followed by San Juan.

In 2002, the Census Nacional Agropecuario carried out by the National Institute of Statistics and Censos estimated that 1 233 589 people reside in agricultural farms, with the provinces of Buenos Aires, Córdoba, Mendoza, Misiones and Santa Fe concentrated the largest number of agricultural establishments.

A substantial part of agricultural production is exported without manufacture in the form of grains (soja, corn, wheat and sunflower), accounting for 15% of total exports. The rest is destined as raw material, mainly to the food industry. Soy is substantially differentiated from the rest of the agricultural products due to the fact that it is not consumed in the domestic market and therefore virtually all is exported. On the contrary, cereals, dairy meats and vaccinated meat are the basis of the population ' s food diet, which is why a considerable part of it is destined to consumption in the domestic market.

Argentina has been characterized throughout the 20th century as one of the world's leading vaccine meat exporters. Likewise, Argentine meat remains recognized as the best quality in the world.

Outside the agricultural-winning economy of the Pampeana region, the Argentine economy has the so-called regional economies, local production systems generally supported in the specialized production of a limited crop group. Among them are the economy whose backed in the vine and the derivative wine industry; the ovine cattle ranching in Patagonia, the Patagonian valleys dedicated to apple and pear; the north-west region, dedicated to sugar, citrus and tobacco; the province of Misiones and north-east of Corrientes oriented to the math grass, tea and wood; cotton in the Chaqueña region; the rice Because of the subtropical climate of many of the areas of the country, Argentina also produces its own tropical crops, such as banana, crana, mango, maracuyá, palta, papaya and coffee, although most of the crops produced is for domestic consumption, as they are not easy to produce in the country.Argentina is one of the largest dairy producers worldwide. Argentina's dairy production is concentrated in the provinces of Buenos Aires, Santa Fe, Córdoba, Entre Ríos, and La Pampa, which make up two large dairy basins: the “cuenca de abasto", which mainly produces fresh milk for consumption, and the "industry basin" specialized in the production of industrial products such as cheese and butter. There are more than 11,500 dairy farms with different production systems. Dairy production in the country went from 6,600 million liters in 1992 to 10,330 million liters in 1999. Continuing a sustained growth of the order of 5.03% per year during the decade 2003-2013, reaching 14,311 million liters in 2014. In 2015, milk production grew by 3%. On the other hand, in the first quarter of 2016, the total produced fell by 3%, the first quarter of 2016. The combination of strong devaluation and reduction of export duties on soybeans and corn significantly worsened the cost equation of dairy farmers and their competitiveness. In 2016, 460 dairy farms were closed, milk production in 2016 would have thrown a drop of 11% totaling about 10.1 billion liters of milk. Argentina is among the five largest world exporters of wheat, with 20 million tons of exportable balance.

Fruits and vegetables

Argentina also stands out worldwide for the production of fruits and vegetables, which constitute 3 % of total exports. It has important production centers in the Patagonian valleys, dedicated to apple and pear, and in the Northwest region producing sugar, citrus and tobacco. In the last 20 years, the production of sugar has recorded a significant growth, going from 1 500 000 t (one million five thousand tons) per year on average in the 1990s to 2 300 000 t (two million three hundred thousand tons) in the period 2006-2010.

The country is one of the world's largest fruit countries, being the first producer in the southern hemisphere in pepita, carozo and citrus fruits. Currently, more than 20 types of fruits and their by-products are exported worldwide. The largest export growth occurred in the last 20 years: volume was quadrupled and export value was sextuplied. Mesopotamia is also a producer of citrus, and the region of Cuyo, where, in turn, there is considerable agro-industrial production of olive and grapes, is the first wine producer in Latin America and the fifth producer in the world, with 16 000 000 hL (diecise million hectoliters) per year. There are the oasis of the provinces of Mendoza and San Juan. Other important crops are peaches and citrus. With an area of about 6000 km2 (six thousand square kilometres), the production of fruit is about 18 000 000 t (eight million tons) per year. In the last ten years, the country achieved a record of production and exports in legumes, pears, apples, cotton, tobacco, citrus, honey, garlic, onion and table grapes. In the period 2003-2011, external sales of regional economies increased 212 per cent. The apples and pears are the most important fruit crops, produced mainly in the river valleys of Río Negro and Neuquén. In 2016 the production of pears and apples was the worst of the last 10 years and 15.5 % lower than the average of the last decade. In terms of exports, 9.6 percent less fruit was traded in 2016. Some of the most significant mermas in the regional economies are the sales of San Juan plums (–96.4 %), Neuquén peaches (–73.2 %), Mendoza pears (–46.7 %) and Río Negro apples (–18.2 %).

Argentina is the world's largest producer of lemon, with 22 % of global production, in 2012 there were about 1 800 000 (one million eight hundred thousand tons), the double that in 1990. It is the largest producer and exporter of grapes, the world's largest producer and exporter of pears, concentrating 40% of the production of the southern hemisphere, the largest exporter and second world producer of honey, concentrating a quarter of the world's exports of this product, and the fourth exporter of wines. It is also the largest South American producer of black truffles.

It is also the first plum producer in the southern hemisphere. The country exported, in 2012, 817 090 t (eight seventeen thousand ninety tons) of vegetables and legumes, such as garlic, onion, chickpeas, potatoes, lentils, pumpkin, among others, to more than 89 countries.

In the first decade of the 21st century, the area planted with kiwis, bananas and mangos in Argentina had a great growth with the support of the National Institute of Agricultural Technology (INTA). Its surface was doubled in 10 years (2005-2015): between ananá, papaya, palta, banana and mango, the total production in these regions is 115 350 t (five thousand three hundred fifty tons), with the requirement of an important labor force throughout the year for the recorded growth volume. However, in 2017 the annual production of bananas in Argentina was the least in 40 years.

Argentina is the world's largest producer of yerba mate, with about 700 000 t (six thousand tons) per year (between 56 and 62 % of world production), followed by Brazil, with about 500 000 t (five thousand tons) per year (between 34 and 36 % of world production), and Paraguay, with 50 000 t (five thousand tons) per year (5% of world production).

They also produce vegetables, mainly potatoes, onions and tomatoes, which are grown throughout the country, almost exclusively for the domestic market. Other important products are sweet potatoes, pumpkins, carrots, beans, peppers and garlic. An area of approximately 3000 km2 (three thousand square kilometers) produces more than 5 000 000 t (five million tons) of vegetables each year.Oil

Currently, oil in Argentina, together with natural gas and petrochemical products, are the second largest export product, responsible for 20% of the total, of which only 4.6% are exported raw, without industrialization. Argentina possesses considerable oil and gasiferous wealth, which allows it to organize a petrochemical production chain that, together with the soy chain and the metal-mechanical industry, constitutes the basis of the national economy.

The main sites are in the province of Neuquén, the Gulf of San Jorge and the province of Salta. The Neuquén province concentrates about half of all hydrocarbon production. A network of pipelines and pipelines transports the products to Bahía Blanca, where the main petrochemical pole is located and the industrial conurbation that extends between Rosario and La Plata and has as its main core the Gran Buenos Aires.

Argentina has the third largest gas reserve on the planet. According to estimates from the United States Department of Energy, Argentina ranks fourth in unconventional oil reserves and second in slate gas. The country has reserves for 27 billion barrels of unconventional oil.

In the last decade there was a process of renationalization of the hydrocarbon business. In 2012, the statization of YPF, the most important hydrocarbon company in the country, in 2013 the Argentine group Bridas bought the businesses of the American ExxonMobil in Argentina, Paraguay and Uruguay, including 530 vendium mouths in Argentina. In 2015 Argentinian Pampa Energía formalized the purchase of Petrobras Argentina for US$ 892 million and around 100 service stations.

By 2015 YPF reached 62.5 % of premium Argentine market share and 55.7 % of super nafta. During the first quarter of 2016 YPF showed a fall in its operating profits of 63.8 percent. In the first semester of 2017, the production of oil and gas in Argentina was the worst in 25 years and was just above 1981, backwards its production level 36 years.

260 wells have been drilled in the unconventional resources area of Vaca Muerta, with an investment of $3,000 million, for this venture YPF has been associated with companies such as Chevron, Dow Chemical and Petrobras. YPF increased its production by 5.6 % in 2014 with respect to the production of 2011, while the production of gas increased to 31 % for the same period. To this end, the triple drilling equipment was acquired, from 25 in 2011 to 75 in 2014.

Raw extraction decreased by 1.44 per cent during 2014, according to data from the Energy Secretariat. However, if the focus is placed on production by provinces, Chubut is the largest producer, with an increase of 2.8%, but in Santa Cruz there was a decline of 3.18 %. The production of the province of Neuquén grew by 2.24 % thanks to unconventional resources. In Mendoza the extraction of crude also low by 3.7 %. The four provinces mentioned above represent just over eight out of ten cubic meters that are extracted. YPF was the company that experienced increased growth in hydrocarbon production, with an increase of 8.85 % (thanks also to the acquisition of Petrobras assets), while Pan American Energy that explodes in Cerro Dragon, Chubut province recorded an increase of 2.69 %, while Pluspetrol and Sinopec recorded losses of 4.7% and 15%.

By 2018, crude extraction decreased by 8.1% compared to 2014. However, it grew 2.1% over the past year, the first year of growth since more than a decade. In Gas Natural, extraction exceeded that of 2014 by 13.5% (and by 5.3% in the previous year). The increase in the amounts extracted is mainly explained by the development of Vaca Muerta and the incorporation of new deposits in the Austral Basin and were the result of the implementation of important incentives by the National State.

Argentina's oil production in 2017 was 580 000 barrels per day, falling to 469 000 barrels per day in 2020 due to lack of investment. Natural gas production also fell between 2015 and 2020, just under 798 000 barrels of equivalent oil in 2020. After almost twenty years as an energy exporter, a combination of oil production in decline and increased energy consumption has meant that Argentina became an energy importer in 2011. Although Vaca Muerta has about 16,000 000 barrels of technically recoverable oil schist and is the second largest deposit of natural gas of schist in the world, the country lacks the capacity to explore the deposit: capital, technology and knowledge that can only come from the energy companies are needed. offshorewho see Argentina and its erratic economic policies with considerable suspicion, without wanting to invest in the country.

For various issues, since the price of the non-conventional crude barrel is around 30 dollars and is not profitable for Vaca Muerta, the reduction of fuel consumption during the 2020 COVID pandemic, the devaluation of the weight and the shortage of dollars, produced that YPF by March of 2021 was worth only one billion dollars, not counting that the company has debts for six thousand two hundred million dollars and still trials. It should be noted that at the time the government of Cristina Kirchner paid Repsol a figure of five billion dollars for 51% of YPF. Although the company has the second deposit of the unconventional gas world and the fourth oil located in Patagonia - so there were high expectations about foreign exchange revenues thanks to the deposit - neither she, nor her successor Mauricio Macri, had active policies to activate their potential.Energy

In 2017, Argentina was the world's 18th largest producer (and the largest producer in Latin America) of natural gas (44.6 billion m³ per year). In 2017, the country was the 18th largest gas consumer (48.5 billion m³ per year). It was the 31st largest gas exporter in the world in 2007: 2.6 billion m³ per year In 2020, the country was the 28th largest oil producer in the world, extracting 440,300 barrels/day. In 2019, the country consumed 599 thousand barrels / day (the 30th largest consumer in the world)..

In renewable energy, in 2020, Argentina was the 27th largest producer of wind energy in the world, with 2.6 GW of installed capacity, and the 42nd largest producer of solar energy in the world, with 0.7 GW of installed capacity. In 2020, the country was ranked 21st in the world in terms of installed hydroelectric power capacity (11 GW).

Mining

Mining in Argentina benefits from geological characteristics that favor mining. The Argentinian part of the Cordillera de los Andes media and austral – about 3500 km from north to south, approximately half of the total length of the mountain chain – which constitutes its western boundary, the mountain widening of the area of the precordillera in the provinces of Mendoza, San Juan, La Rioja and Catamarca, the longitudinal valleys between both formations and the transverse valleys, is still mining.