American dollar

The US dollar or American dollar (also abbreviated with the symbols $, US$ or its international standard USD) is the legal tender of the United States, its dependencies, and other countries. The dollar is the most important international reserve currency in the world and also the most used in international transactions. Its status as the world's reference currency has made it the official currency of several countries and the de facto currency in many others, that use their paper money for current transactions or give a fixed exchange rate to their national currencies against the dollar. Monetary policy in the United States is run by the Federal Reserve System, which acts as the nation's central bank and is also in charge of issuing dollars. The ISO 4217 code for this currency is USD.

This currency was created in 1792, with the approval of the Coinage Act, which introduced the dollar, divided into 100 cents and with a value equal to the real of 8 Spanish and the authority for minting coins denominated in dollars and cents. The US dollar, whose most characteristic and historically predominant color has been green on its bills, was originally characterized by bimetallism: its value was fixed at 24,057 grams of fine silver or, since 1837, at 1,505 grams of gold or 20.67 dollars per troy ounce. The Gold Standard Act of 1900 broke with bimetallism by pegging the dollar solely to gold. The dollar became a major reserve currency from the end of World War I and displaced the pound sterling as the world's leading reserve currency after the Bretton Woods agreement at the end of World War II. In 1934, its equivalence with gold was revised up to 35 dollars per troy ounce, a value that it would maintain over several decades, until in 1971 it was definitively disassociated from the gold standard, for which the currency was converted, from facto, in a fiat currency.

Although this kind of dollar is issued only in the United States, fourteen more countries use the name "dollar" for their currency. For their part, other nations such as Ecuador, El Salvador, Panama and East Timor, through ratifications and agreements or as a substitute for their own weakened currency, have chosen it as their official currency and legal means of payment.

As of June 2021, physical currency in circulation stood at 2.10 billion, 2.05 billion of which was in the form of Federal Reserve notes and the remaining 50 billion in the form of US coins and other bonds or notes.

The dollar sign

There are several versions of the origin of the symbol $, most pointing to a Hispanic origin. The one that is possibly the most widely accepted, according to the United States Office of Engraving and Printing, is that it is the result of the evolution of the New Spanish and Spanish abbreviation Ps, which abbreviated pesos, piastres, or pieces of eight. This theory, derived from the study of manuscripts from the 18th and 19th centuries, explains that the s gradually came to be written over the P, developing an equivalent close to $ . The symbol was widely used before the adoption of the USD in 1785.

Another is that the symbol was derived from—or inspired by—the mintmark of the city's Spanish colonial mint. In it was the Potosí mine, in the current country of Bolivia. This mintmark was composed of the letters PTSI superimposed one on top of the other, forming a symbol very similar to the original dollar sign (that of a vertical bar: $). Spanish silver reales—the "pieces of eight"—were in common use in the English colonies of North America. A large part of those coins would be minted in the Potosí mine. These, moreover, would have had a somewhat high profile, since the Potosí silver mine was supposedly the largest in history, so much so that Potosí became for a time the largest city in all of America and its fame was worldwide in that time.

Currently, in some cases, the variant with two vertical bars is still used. This variant is sometimes attributed to the idea of superimposing U and S (from United States), but it seems that it already existed because of the time when the area was a British colony. The symbol would be a stylization of the Pillars of Hercules that appeared in the coins minted in the Mint of Mexico, the reales of 8 called columnarios. The vertical bars would be the columns and the S would be the band with the legend "Plus Ultra" that wrapped it. A seal with this shape was stamped on the gold and silver ingots that traveled in the Fleet of the Indies bound for the Royal Treasury. The single bar version is a simplification of the two bar original.

Finally, the similarity of the dollar symbol with that of the sestertius (IIS, I IS or HS) might suggest that a Roman origin. However, in ancient manuscripts the sestertius symbol never appears with the vertical strokes superimposed on the letter S.

Exchange rate and listing

Currently all the world's currencies are tied to each other according to capital flows, which causes exchange rates and prices to vary. This lattice system of leagues is what gives value for money.

For a long time, the dollar was the pillar of the world economy, being this the basis for exchange rates and world prices. Now with the euro there is a greater web of tug of war of the leagues that unite the world currencies.

For Joseph Stiglitz, the dollar reserve system is part of the crisis, as it drives much of the cash into the US. He suggested creating a new global reserve system. Zhou Xiaochuan—governor of the Chinese central bank—proposed the same, calling for the creation of a new currency and for the IMF to issue the new currency.

The official coins of the United States have been produced every year from 1972 to the present.

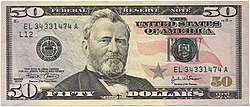

Dollar bills

Description

The United States Constitution provides that Congress has the power to "borrow the money of the United States on credit." Congress exercises this power by authorizing the Federal Reserve Banks to issue Federal Reserve Notes. These notes are "obligations of the United States" and "will be exchanged for legal money at the United States Department of the Treasury, in the city of Washington (District of Columbia), or at any Federal Reserve Bank". the Federal Reserve are by law the "legal tender" for the payment of debts. On the other hand, Congress has authorized the issuance of more than 10 types of dollar banknotes throughout history, although the Federal Reserve note is the only one remaining in circulation since the 1970s.

Federal Reserve Notes are printed by the Bureau of Engraving and Printing and are made from cotton fiber paper—as opposed to regular paper, which is made from wood fiber. The "large-size notes" issued before 1928 measured 188.5 mm × 79.4 mm, while the small notes introduced that year measure 155.96 mm × 66.29 mm × 0.11 mm. The dimensions of modern US (small-size) notes are identical to the size of the Philippine peso bills issued during the United States administration after 1903, which enjoyed great success among the population.

Currently printed denominations are $1, $2, $5, $10, $20, $50, and $100. Notes above $100 went out of print in 1946 and were officially withdrawn from circulation in 1969. These notes were used primarily in interbank transactions and in organized crime deals; it was this latter use that led President Richard Nixon to issue an executive order in 1969 to stop its circulation. With the advent of electronic banking, they became even less necessary. Notes in denominations of $500, $1,000, $5,000, $10,000, and $100,000 were all produced simultaneously, except for the $100,000 note, which was only issued as a 1934 series gold certificate and never publicly circulated, so that its possession is illegal. High denomination and uncirculated notes have become collector's items and are valued by collectors more than their face value.

Although it is still predominantly green, the series after 2004 incorporate other colors to better distinguish the different denominations. In 2008, the American Council of the Blind petitioned the Bureau of Engraving and Printing for physical changes to the notes to increase their legibility. In response to that demand, a raised "tactile feature" was planned to be added to the next redesign of every bill, except the $1 and $100 bills. It is also planned to enlarge the size of the numerals and give them greater contrast, in addition to increasing the differences in color and distribution of coin readers to help the visually impaired during the transition period.

International use

Precedents

Colonial notes, issued by the Massachusetts Bay Colony, began to be issued in 1690. Over time, and especially in the War of Independence, other currencies emerged such as the "continental currency& #3. 4; which soon lost its value.

Between the 16th and 19th centuries, the reference currency for international trade between Europe, Asia and America was historically the 8 real, also known in English as the "Spanish dollar", thanks to the fact that it established a standardized and global system of silver, an abundant metal thanks to its massive extraction in the Spanish colonies and which guaranteed the durability of the currency over time. The US dollar derived directly from the real of 8. The Spanish real would eventually be replaced as the currency of reference for the pound sterling and the establishment of the gold standard in the last quarter of the XIX century.

The US dollar began to replace the pound as the hegemonic international reserve currency from the 1920s, as the country emerged unscathed from World War I and was a major recipient of gold during the conflict. After the United States became the hegemonic superpower after World War II, the Bretton Woods agreement of 1944 established an international monetary system where the US dollar became the main reserve currency and reference currency in world trade. It was also the only postwar currency linked to gold, as the United States held 75% of the gold reserves at the time, with a value of $35 per troy ounce. The rest of the important currencies maintained a fixed exchange rate against the dollar, an exchange rate that each country ensured through its monetary policy and the help of the International Monetary Fund and the World Bank. This system ended in 1971, when the The dollar abandoned the gold standard, although the currency continued to play a preponderant role that continues to this day.

The green color of the dollar is due to the fact that, in 1861, the Treasury Department began issuing "demand notes" calls "greenbacks" as they had green ink on the reverse.

International reserves

The US dollar is, along with the other major world currencies—the euro, the pound, the yen, and the renminbi—in the International Monetary Fund's basket of special drawing rights currencies. The central banks of all countries have large reserves of dollars on their deposits and are major buyers of United States Treasury bills and notes. The dollar has been the primary reserve currency worldwide since the end of World War II. World Cup, although since its peaks in the 1970s its share has progressively decreased —from almost 85% in 1975 to 59% in 2020.

Foreign companies, organizations, and individuals hold US dollars in foreign deposit accounts called Eurodollars—not related to the euro—that are outside the jurisdiction of the Federal Reserve. Individuals also hold dollars outside of the banking system, mostly in the form of $100 bills, an estimated 80% of which are outside the United States.

The United States Department of the Treasury exercises strong oversight over the SWIFT financial transfer network and consequently has significant influence over global financial transaction systems and the ability to impose sanctions on foreign companies and individuals.

Global Markets

The US dollar is the predominant standard monetary unit in which goods are quoted and traded and with which payments are settled in world commodity markets. In the latter market, the influence of the dollar is so strong that Historically, the rule exists that when the dollar strengthens, the price of raw materials falls, since it is the reference currency for most commodities. The dollar index is an important indicator of the strengths or weaknesses of the dollar against the six most important foreign currencies.

Because of its strength, the United States government is able to borrow trillions of dollars from the global capital markets issued by its central bank, the Federal Reserve, which is in turn under the control of the United States government itself. the United States. This brings as a benefit for the State minimum interest rates and a practically null risk of non-payment. Conversely, foreign governments and companies unable to borrow in their own local currencies are forced to issue US dollar-denominated debt, which brings with it higher interest rates and greater risks of default. The ability of the United States to borrow in its own currency without facing a significant crisis in its balance of payments has often been described as an "exorbitant privilege".

Due to long-term fluctuations in the price of the dollar, as well as its global influence, there is an ongoing debate about whether monetary policies to consolidate a "strong dollar" are beneficial or not for the United States and by extension for all the world. Historically, the US government has preferred a strong dollar to a devalued one, which entails lower interest rates for the country and a greater capacity to import products and borrow, although as a counterpart, a rising dollar reduces export competitiveness to the US.., resulting in its strong trade deficit.

Use of the dollar in other countries

Nations other than the United States use the US dollar as their official currency, a process known as official dollarization. For example, Panama has been using the dollar along with the Panamanian balboa as legal tender since 1904 at a 1:1 conversion rate. Ecuador (2000), El Salvador (2001), Puerto Rico (1917) and East Timor (2000) have independently adopted the currency. Countries that were dependent territories of the United States, such as Palau, the Federated States of Micronesia, and the Marshall Islands, chose not to issue their own currency upon gaining independence, so they continued to use US currency. Two British dependencies also use the US dollar: the British Virgin Islands (1959) and the Turks and Caicos Islands (1973). Other countries use the US dollar and other foreign currencies at the same time as their local currency, such as Cambodia and Zimbabwe.

The adoption of the dollar as the official currency by third countries entails both benefits and risks for these nations. Since countries that normally opt for "dollarization" tend to have weak economies and currencies, the economic literature tends to point to price stability—low inflation—lower transaction costs, greater access to the international market, and greater access to international markets as potential benefits. better control of public finances. On the contrary, the adoption of the dollar implies the resignation of monetary sovereignty by that country —in addition to the right of seigniorage— and the impossibility of using monetary policy tools when the economy is seen compromised, since control of the currency is in the hands of the United States, whose economic policy does not have to be favorable to the situation of the "dollarized country". The very difficult it would be to abandon the dollar as a currency or the loss of commercial competitiveness, especially in the case of developing countries, is also normally pointed out as a potential drawback.

For its part, in Venezuela since 2019 a de facto dollarization has been established (it has not been made official), due to the devaluation of the local currency (sovereign bolivar). In that country, the US dollar is spent mainly on non-essential goods or those whose cost in local currency would be exorbitant. However, since 2020 it has even been extended to some essential goods, given the hyperinflation and mega-devaluation of the bolivar. Below is a list of countries that have created their own fractional dollar coins after adopting the US currency as their official currency:

Although they have their own sovereign currency, other countries keep their currency pegged to the value of the US dollar, including:

- In the Caribbean: Bahamas dollar, Barbados dollar, Belize dollar, Bermuda dollar, Cayman Islands dollar, Eastern Caribbean dollar, Netherlands Antilles and Aruban guild.

- Arab oil-producing and exporting countries, as oil trade deals in dollars: the Saudi riyal, the United Arab Emirates dirham, the Omani riyal, the Qatari riyal and the Bahraini dinar.

- Others: the Hong Kong dollar and the Machaian potato.

Change Rates

| Current exchange rate of USD | |

|---|---|

| Google Finance Data: | AUD CAD CHF EUR GBP HKD JPY |

| Yahoo data! Finance: | AUD CAD CHF EUR GBP HKD JPY |

| XE.com data: | AUD CAD CHF EUR GBP HKD JPY |

| OANDA.com data: | AUD CAD CHF EUR GBP HKD JPY |

| fxtop.com data: | AUD CAD CHF EUR GBP HKD JPY |

Contenido relacionado

Global city

Cattle raising

Cliometrics